India: Exclude steel from free-trade pacts, say wary manufacturers

Financial Express | 9 July 2015

Exclude steel from free-trade pacts, say wary manufacturers

Domestic steelmakers have urged the government to keep steel out of the purview of any future free-trade agreements

By: Surya Sarathi Ray | New Delhi

Domestic steelmakers have urged the government to keep steel out of the purview of any future free-trade agreements (FTAs) and also review the existing pacts to ensure that their interests are safeguarded.

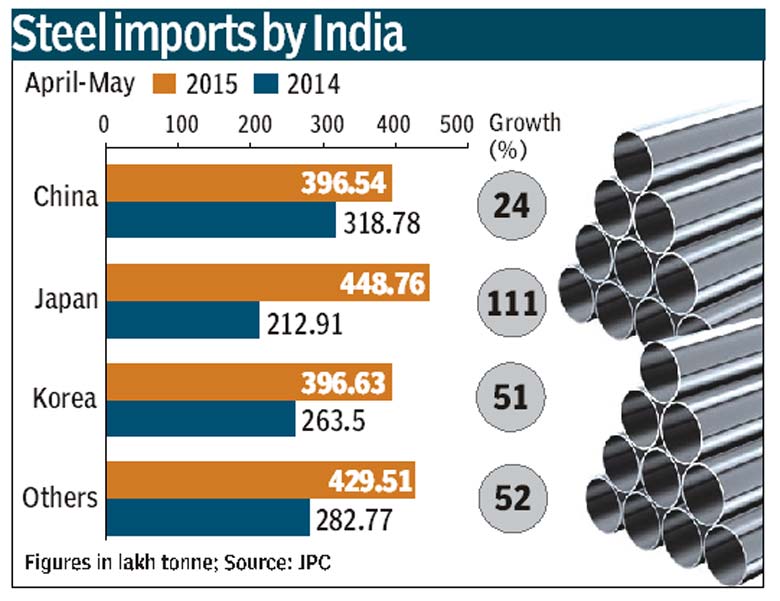

China, Japan and Korea are the three major exporters of steel to India cumulatively, contributing around 75% of the total 9.3 million tonne (mt) steel imported last fiscal. India has FTAs with Japan and Korea and proposes to enter into a free-trade agreement with China with the signing of a Regional Comprehensive Economic Partnership (RCEP).

Taking advantage of the duty benefits under FTAs, steelmakers from Japan and Korea have already become a serious threat to the Indian steel industry. With a huge exportable surplus, China is not just a growing threat for India, but to almost all the steelmaking nation in the world.

Recently, the import duty on various steel products were raised by 2.5%, but this failed to allay the steelmakers’ concerns given that the low-tax imports from FTA countries continued. The steel industry’s demand for keeping steel out of the purview of future FTAs is also backed by the steel ministry, sources said.

Steelmakers are of the view that any new FTA with a huge exportable-surplus country like China would harm them as it could open the floodgates for imports, resulting in further deterioration of their present depressed condition.

After growing by 71% to 9.3 mt last fiscal, steel imports rose by 53.1% to 2.54 mt in the first quarter of the current fiscal.

While steel from Japan, Korea and Russia are high-grade items, China has started exporting even for those used in the construction sector. All the countries, domestic steelmakers alleged, are “dumping” steel at below their manufacturing cost.

“Out of the 36 best identified companies by the World Steel Association, five are in India. This means that we have the capacity and technology to produce all the steel required for the country. But the capacity utilisation by the Indian steel companies are now hovering between 75-80%, with 20% of the 110 mt installed capacity lying idle,” said a government official.

An official with a private sector firm said India’s trade deficit with Korea has jumped by $22 billion while that with Japan has gone up by $6 billion. “Most of the FTAs are, in general, in terms of trade, not in favor of the Indian industry,” he said.

Since Indian steelmakers are deprived of lower interest and transportation costs compared to their peers, they are loosing to their counterparts in China, Japan and Korea on higher iron ore prices as well. Thus, the need is not to provide duty-benefit to the export surplus countries, but to to raise the duty to 15% so that a level-playing field can be created.

A senior steel ministry official said the demand of the steelmakers was “genuine” and have the “backing” of the ministry.

“Their demands will be discussed at a meeting convened by the commerce ministry with all stakeholders of the steel industry,” he said on the issue.