Morocco-Canada FTA – investment at the price of trade deficit

All the versions of this article: [English] [français]

L’Économiste | 2012/07/23

This is a free translation by Anoosha Boralessa (May 2015). Not reviewed or revised by bilaterals.org or any other organization or person

Morocco-Canada FTA – investment at the price of trade deficit

Author: Ayoub NAÏM

– Hardly any visible trade benefits

– A very similar scheme to the Morocco – US FTA

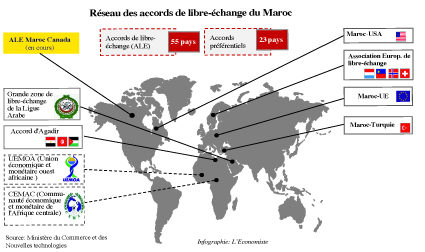

If Morocco signs the FTA with Canada, it will become the first African country to enter into a free trade agreement with Canada; it will also develop its list, already substantial, of preferential free trade agreements.

The free trade agreements that Morocco has signed multiply and the country does not seem to want to confine itself to its current list of FTAs. After the European Union, the Arab nations, the United States, Turkey… now it’s Canada’s turn, the 13th global importer. Canada, the US and Mexico are all parties to NAFTA, one of the most dynamic free trade areas in the world. Theoretically there is substantial room for Moroccan products, notably fresh or dried citruses, textile articles, shoes and leather articles. These are the bread and butter of our exports to Canada. But there is no need to pull the wool over our eyes:

“if Morocco signs this agreement, it is primarily to woo foreign investors.”

So declared Jawad El Kerdoudi, President of the Moroccan Institute for International Relations.

It is necessary to skim over our exchanges with Canada to understand that they are still very limited and, importantly, barely diversified. The agreement that is being negotiated takes place in a similar context to the one that links Morocco to the United States. Small gains as far as trade goes, but very big stakes where investments are concerned. Canadian investors are solicited throughout the world and there is no doubt that a Sub-Saharan Africa presence is inevitable.

If this agreement is signed, Morocco will become Canada’s point of entry to these countries. It could therefore benefit from the presence of big international actors in technical domains such as new IT technologies, electronics, electricity and hydro electricity – these are some sectors where Canada has recognized expertise.

Just like the US FTA, the Canada FTA had to institute and reaffirm, a few ground rules.

“ At issue are assurances for the repatriation of profits, compensation without discrimination in the event of an expropriation, abolition of double taxation and the opportunity to have recourse to arbitration in the case of a dispute.”

So forecast the President of the Moroccan Institute for International Relations.

Another very sensitive subject for Anglo Saxons: intellectual and trade property. This point will certainly have a preponderant place among the treaty provisions. On the other hand, if you take a purely commercial approach, factoring in the asymmetry between our two economies, for sure, Canada will profit more than Morocco. According to the most recent statistics on foreign trade, our trade deficit with Canada was 2.5 billion DH in 2011.

Our exportable offer to Canada is focused on citruses. At the end of 2011, these reached the equivalent of 236 millions DH in exports. According to the professionals, the situation does not risk improving when the Canada-Morocco FTA enters into force. Even our flagship product will not be able to offset the balance.

“market capacity is limited to fruits, mainly clementines. Today the market is saturated.”

So stressed M’hamed Loultiti, the President of Maroc-Citrus.

In this scheme, Morocco cannot yet compete with other varieties of citruses on the Canadian market, notably Californian oranges which almost have a monopoly. This is all the more so since the long distance requires that agricultural products undergo a special treatment.

“ The transition time is too long. We have to abandon all hope of seeing products as fragile as the Moroccan tomato sold on the Canadian market” emphasized Loultiti.

On the other hand, no limits have been placed on seeing Canadian durum wheat from winning new positions on the Moroccan market (Canada is the no. 1 provider of durum wheat in the world). Ahmed Ouayach, the president of Comader, “does not think this is anything to get excited about because it responds to an important local need.” On the other hand, prudence is advised for other agricultural products. Ouayach warns:

“the conditions for treatment for other agricultural products will have to be handled with the utmost care by Moroccan negotiators. This is especially so where protection systems and quotas are granted.”

In this regard, it is emphasized that Morocco signs up to the approach of a “positive list” accompanied with a clause of “rendez-vous”. In contrast, Canada proposes that when the agreement enters into force, all agricultural products are submitted to a scheme of progressive tariff dismantling.

The pharmaceutical industry trembles

Pharmaceutical manufacturers are also concerned by the future agreement. Morocco’s fourth biggest import from Canada is medicine.

“An open position vis-à-vis the pharmaceutical products that can be imported does not satisfy us. It would be an important risk for the national industry.”

So affirms Abdelghani Guermaii, president of the Moroccan Association for Pharmaceutical Industry (AMIP). However, the laboratories are aware that for certain therapeutic classes, they will be able to benefit from Canadian expertise.