29-Aug-2014

Computer World

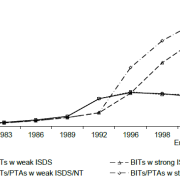

A Senate inquiry has recommended against passing a bill that would bar Australia from entering into trade agreements that include so-called ’investor-state dispute settlement’ clauses.

28-Aug-2014

European Commission

The European Union today took an important step towards creating a comprehensive EU investment policy, with the publication of a Regulation setting out a new set of rules to manage disputes under the EU’s investment agreements with its trading partners.

28-Aug-2014

Kluwer Arbitration Blog

Indonesia is not the only Asia-Pacific nation that is reassessing investment treaties containing provisions on Investor-State Dispute Settlement (ISDS, especially arbitration).

28-Aug-2014

Jakarta Globe

US firm Newmont Mining has withdrawn its arbitration claim against Indonesia

27-Aug-2014

S&D Group in the EP

The Socialist & Democrat Group in the European Parliament has always opposed the inclusion of the investor-state dispute settlement mechanism in CETA, says their president G. Pitella, and it will be up to the Parliament to decide whether or not to ratify the agreement.

23-Aug-2014

Public Citizen

Pacific Rim Mining Corp., a Canadian-based multinational firm, sought to establish a massive gold mine using water-intensive cyanide ore processing in the basin of El Salvador’s largest river, Rio Lempa.