Canadian takeovers made easier with Europe trade accord

Bloomberg | Oct 22, 2013

Canadian takeovers made easier with Europe trade accord

By Theophilos Argitis & Andrew Mayeda

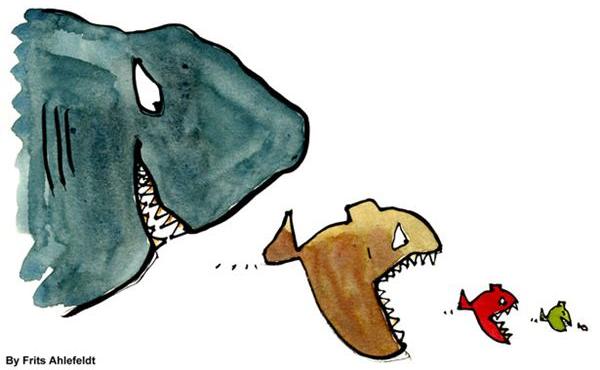

Companies from Birchcliff Energy Ltd. (BIR) to Painted Pony Petroleum Ltd. will find it easier to attract foreign suitors after Canadian Prime Minister Stephen Harper lifted hurdles for U.S. and European investors.

Canada will raise the threshold for reviewing foreign investment from European Union countries to C$1.5 billion ($1.5 billion) as part of its trade agreement with the region announced last week. The pact with Europe means Canada is obligated to also raise the threshold for all countries it has free trade agreements with, including the U.S.

The move may help resource companies find new sources of capital in the U.S. and Europe even as Harper has been increasing scrutiny of investments from state-owned enterprises, largely from Asian countries such as China. Mergers and acquisitions in the oil sands fell this year to the lowest since 2004, data compiled by Bloomberg show.

“Increasing the threshold to C$1.5 billion opens up the playing field for entities trying to get into Canada,” said Jeremy McCrea, an analyst at AltaCorp Capital Inc. in Calgary. “If you’re going down that path, and looking to make a sizable investment in Canada, at least you have some comfort that it’s not going to be subject to review.”

Energy companies such as Crew Energy Inc. (CR), Bellatrix Exploration Ltd. (BXE), Painted Pony and Birchcliff, all based in Calgary, could see their chances of being acquired improve, McCrea said in a telephone interview yesterday.

Market Orientation

Birchliff, the owner of more than half a million acres of undeveloped oil and gas prospects in Alberta, had considered selling itself to a buyer in 2011, a search the company said in March last year it was putting off as natural gas prices fell.

Jim Surbey, a spokesman for Birchcliff Energy, Bellatrix Chief Executive Raymond Smith and Crew Energy Chief Financial Officer John Leach didn’t immediately respond to a call for comment.

“Anything that opens it up without government interference is always good for business,” Patrick Ward, CEO of Painted Pony (PPY), which owns natural-gas assets in British Columbia, said by phone yesterday. “We’re not actively having the company for sale or anything at this point, but people are always looking for shareholder value, so it certainly does weigh on people’s decisions, how open Canada is for business,” Ward said.

The increased threshold underscores Harper is placing on advanced market-oriented economies as he seeks foreign capital to sustain the recovery, even as scrutiny of investment from emerging countries such as China is heightened. Canada’s 14 free trade partners produced about $36.4 trillion in gross domestic product last year, representing about half of global output, according to International Monetary Fund data.

India, Singapore

In addition to the U.S., Mexico and the EU, Canada has free trade agreements with Norway, Iceland, Switzerland, Liechtenstein, Panama, Jordan, Colombia, Peru, Costa Rica, Chile, Israel and Honduras.

Canada is also negotiating free trade agreements with Japan, South Korea, India and Singapore and is part of the Trans-Pacific Partnership trade talks seeking a Pacific-region agreement.

The Canadian government currently reviews foreign takeovers of businesses with assets of at least C$344 million. Harper had already planned to raise that threshold for all private investors for companies with an enterprise value of C$1 billion, while keeping it at the existing level for state-owned enterprises.

Oil Sands

“By necessity, it should be understood it raises that threshold not only for Europe, but for all countries with which we have trade agreements,” Harper said in an Oct. 18 interview in Brussels. “Obviously, the 42 countries in the world with which we have free-trade agreements are good partners that give us few or no concerns.”

Lifting the threshold to C$1.5 billion will remove about 212 Canadian-based publicly traded companies from the government’s automatic review list, according to Bloomberg data.

Harper last year implemented investment restrictions for state-owned companies, including a ban on future oil-sands takeovers except under “exceptional circumstances.”

After that policy came into effect, mergers and acquisitions in the oil sands slowed. Smaller developers including Birchcliff and BlackPearl Resources Inc. (PXX) are lagging behind peers after the government introduced the rules. Birchcliff fell 5.4 percent since the rules were made public on Dec. 7, versus a 9.0 percent gain on the Standard & Poor’s/TSX Energy Index.

Lost Capital

Falling investment prompted Jim Prentice, a former industry minister for Harper and vice chairman of Canadian Imperial Bank of Commerce, to call on the government last month to clarify its foreign investment rules.

“Canada must make clear to the world that it continues to be open for business,” Prentice said in an Oct. 1 speech in London. He cited data that showed acquisitions in Canada’s energy sector totaling C$8 billion this year, down from C$66 billion in 2012.

Increased investment from Europe and the U.S. won’t match lost capital from Asia, said Eric Nuttall, who oversees C$70 million at Sprott Asset Management LP in Toronto.

“It’s had a profound impact on some companies,” Nuttall said in a telephone interview. “There is an increased confusion amongst the part of certainly Chinese companies in terms of just how welcome they are.”

Canada has increasingly relied on foreign capital to finance investment, running cumulative current account deficits of C$265 billion since the last quarter of 2008. The current account is the broadest measure of international trade.

Under the Canada-EU pact, EU investments can still be reviewed to determine whether they are of “net benefit” and meet national security requirements, Harper said.

“I think it would be far-fetched to see any kind of European investment as a national security challenge,” he said.

To contact the reporters on this story: Theophilos Argitis in Ottawa at targitis@bloomberg.net; Andrew Mayeda in Ottawa at amayeda@bloomberg.net

To contact the editor responsible for this story: David Scanlan at dscanlan@bloomberg.net