An inconvenient truth about free trade

Bloomberg | 31 March 2016

An inconvenient truth about free trade

by Peter Coy

It’s easy to scoff at the anti-free-trade rhetoric emanating from the U.S. presidential campaign trail. Donald Trump keeps yelling about China, Mexico, and Japan. Bernie Sanders won’t stop shouting about greedy multinational corporations. Hillary Clinton, Ted Cruz, and John Kasich are awkwardly leaning in the same direction. If you’re a typical pro-trade business executive, you’re tempted to ask: Were these people throwing Frisbees on the quad during Econ 101? A recent article in the National Review expressed disdain by blaming a swath of America for its own problems, attributing Trump’s success to a “white American underclass” that’s “in thrall to a vicious, selfish culture whose main products are misery and used heroin needles.”

Wait. Trump and Sanders may be clumsy and overly dramatic, and their solutions may be misbegotten, but they’re on to something real. New research confirms what a lot of ordinary people have been saying all along, which is that free trade, while good overall, harms workers who are exposed to low-wage competition from abroad. Ignoring this damage—or pretending that it’s being cured through “redistribution” of gains—undermines the credibility of free traders and makes it harder to win trade liberalization deals.

“Economists, for whatever odd reason, tend to close ranks when they talk about trade in public” for fear of giving ammunition to protectionists, says Dani Rodrik, an economist at Harvard’s Kennedy School of Government. “There’s a sense that it will feed the barbarians.”

The theory of comparative advantage that’s taught to college freshmen is impossibly clean: It’s all about specialization. England trades its cloth for Portugal’s wine. Even if Portugal is slightly better at producing cloth than England is, it should focus on what it’s best at, winemaking. Portuguese who lose their jobs making cloth will readily find new ones making wine. Efficiency improves. Everyone wins.

Life is more complicated. For example: In times of slack global demand, countries grab more than their fair share of the available work by boosting exports and limiting imports. Perpetual trade deficits leave one country deep in hock to another, threatening its sovereignty. Financial bubbles form when deficit countries are overwhelmed by hot money inflows. Countries restrict trade for strategic reasons, such as to nurture an infant industry, to punish a rival, or to guarantee a domestic source for sensitive military hardware and software. Nation-states may not appear in intro econ, but they call the shots in the real world.

Even setting aside geopolitics, trade creates losers as well as winners. Back in 1941, economists Wolfgang Stolper and Paul Samuelson pointed out that unskilled workers in a high-wage country would suffer losses if that country opened up to imports from a low-wage nation. (The prestigious American Economic Review rejected the paper, calling it “a complete ‘sell-out’ ” to protectionists.)

American support for free trade was strong for most of the 20th century. The Stolper-Samuelson theorem was of mainly theoretical interest because most U.S. trade was with other developed nations. Besides, economic textbooks assured students that losers from trade could be compensated with a portion of society’s gains. The Trade Expansion Act of 1962 was the first of a series of measures to provide government assistance to U.S. workers who lost their jobs to foreign competition. American labor unions generally supported free trade as both a creator of jobs in the export sector and a bulwark against communism.

Competition from Japan shook some unions’ and lawmakers’ faith in trade. In 1981, Japanese automakers agreed to “voluntary” restraints on auto exports to the U.S. to avoid possible tariffs. A deal with Japan on memory chips followed in 1986. Among economists, though, the consensus in favor of unbridled free trade remained intact. If jobs were lost, they said, it was far more likely to be from automation than from imports. As recently as 1997, Paul Krugman wrote in the Journal of Economic Literature that “a country serves its own interests by pursuing free trade regardless of what other countries may do.”

There’s a U.S. program for compensating people hurt by trade. It isn’t effective

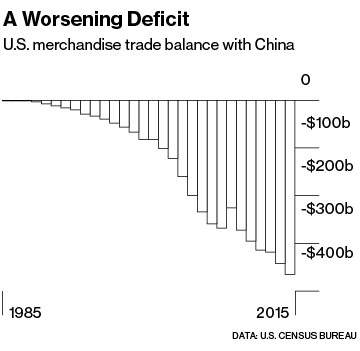

The rise of China did far more than Japan’s ascent to soften the free-trade consensus. China’s low-wage, low-price strategy swept through American industry like a plague. Hardest hit were labor-intensive industries such as apparel, shoes, furniture, toys, and electronics. From 1990 to 2010, according to Bureau of Labor Statistics data, U.S. production jobs in apparel plunged from 840,000 to 118,000. If a U.S. factory couldn’t match the “China price,” it lost the business. Economists have taken note. Krugman wrote in his New York Times column this March that while protectionism is a mistake, “the elite case for ever-freer trade, the one that the public hears, is largely a scam.”

David Autor, a centrist economist at Massachusetts Institute of Technology, has carefully documented the consequences of China’s rise. In a working paper released in January, Autor and two other economists conclude that imports from China killed about 2.4 million U.S. jobs from 1999 to 2011. That wouldn’t have been terrible if the workers had found jobs in other sectors or other cities. But many didn’t. Job growth was slow, so there were few openings. Lots of laid-off factory workers were still living off benefits a decade later, reflecting a “stunningly slow” adjustment, wrote Autor, David Dorn, of the University of Zurich, and Gordon Hanson, of the University of California at San Diego, in their paper, The China Shock: Learning from Labor Market Adjustment to Large Changes in Trade.

Autor says he still believes in free trade, including with China. “We don’t want our work to be misconstrued.” But he says their research did sensitize them to the human price that the U.S. has paid in exchange for low-priced goods from China. In terms of lost incomes and lost pride, Autor says, “the costs loom pretty large.”

Once you accept the idea that some people lose from trade, the question becomes what to do about it. Ordinary Americans are conflicted. On one hand, there’s a reservoir of support for foreign trade. A Gallup poll published in February found that 58 percent of Americans see it as an opportunity, vs. 33 percent who view it as a threat. On the other hand, doubts persist. A Bloomberg national poll in March found that almost two-thirds of Americans want more restrictions on imported goods and 82 percent would be willing to pay “a little bit more” for American-made goods to save jobs. Democrats in Washington state gave Sanders a big primary victory on March 26 even though the state benefits enormously from free trade; it led the nation in manufacturing exports per capita last year, according to U.S. Department of Commerce data.

A 44-nation survey by Pew Research Center in 2014 found strongly positive views toward trade in developing nations, particularly Tunisia, Uganda, Vietnam, Lebanon, and Bangladesh. In contrast, half of Americans said trade destroys jobs, as did 49 percent in France, 59 percent in Italy, and 38 percent in Japan.

The libertarian position on free trade is that those who lose when barriers come down deserve nothing. They were being protected from competition; now their special deal is being taken away to save consumers money. End of story. If anything, some libertarians say, the workers should compensate consumers for the extra income they unjustly earned when the barriers were up. “Where, in short, is my check from those benefiting from protectionism?” Tim Worstall, a fellow of the U.K.’s free-market Adam Smith Institute, wrote on his personal blog in 2011.

The U.S. Congress has rejected that harsh philosophy. In fiscal year 2014, the U.S. Department of Labor gave states $604 million for workers who were certified as having lost their jobs because of foreign competition. The funds cover career counseling, job training, allowances for job search and relocation, wage subsidies for older workers who get hired at lower pay, and weekly cash payments for people whose unemployment benefits are exhausted.

But trade adjustment assistance, as it’s called, is hardly a cure-all. The sums are tiny in comparison with the scale of the problem, and the success rate is low. A study for the Labor Dept. in 2012 by Mathematica Policy Research, a Princeton, N.J.-based evaluation firm, concluded that partly because of the time that participants spent in training, their earnings were actually lower than those of nonparticipants.

Questions about how to share the benefits from free trade are inseparable from broad questions about social justice. Is a trade deal bad if it kills 1,000 jobs in South Carolina but creates 10,000 in desperately poor Bangladesh? Or this: Let’s say social scientists figured out how to make trade adjustment assistance effective. Would it be right for government to ramp up spending on it 100-fold from current levels, so displaced workers are truly made whole, even though that’s more money out of taxpayers’ pockets?

Trade adjustment assistance is an awkwardly shaped government program, too broad in one respect and too narrow in another. If the objective is to right a wrong, then it’s too broad in that it benefits people who lose jobs even when the foreign competition is perfectly fair. If the objective is to provide a safety net, then it’s too narrow in that it covers only people harmed by trade. What about people who lose their jobs because of automation, tougher pollution controls, or changing consumer tastes? It seems unfair to treat those groups differently.

For logical consistency, the assistance needs to narrow or broaden. Harvard’s Rodrik and MIT’s Autor favor broadening—that is, eliminating trade adjustment assistance as a special category and putting a safety net under all workers that doesn’t depend on why they lost their jobs.

A bigger idea is to stop the chronic trade deficits from occurring in the first place. There would be fewer losers from trade and less need for assistance if deficits were small and temporary. John Maynard Keynes, the great British economist, had an idea for that in 1941. His plan would have shrunk imbalances by putting much of the responsibility for adjustment on trade-surplus countries. It would have driven them to spend and import more. Keynes’s plan didn’t appeal to the U.S., which was generating big trade surpluses at the time, so it died. Something slightly similar has been pushed in recent years by Vladimir Masch, a Soviet-born engineer and economist who is retired from Bell Laboratories. His “compensated free trade” plan would have the U.S. impose separate annual limits on trade surpluses of each trading partner and charge the governments if the limits are exceeded. “Unbridled globalization undermines societies and is incompatible with democracy,” he writes.

Trump and Sanders are right that better trade deals are part of the solution, too. Autor et al. show that China benefited hugely from entering the World Trade Organization in 2001. Yet China has managed to restrict access to its market, closing off some sectors, such as finance, while insisting that U.S. and other foreign companies transfer technology to Chinese partners in exchange for joint manufacturing deals.

In 1911, remarkably, free trade was the populist position. It could become so again

As Sanders complains, new trade deals such as the Trans-Pacific Partnership and the Transatlantic Trade and Investment Partnership seem aimed more at securing the interests of multinationals than creating jobs back home. In other words, supporting trade deals doesn’t automatically make a chief executive a free-trade purist. “My view is that there are barbarians on both sides of this issue,” says Rodrik.

Thomas Palley, an economic policy adviser to the AFL-CIO, says multinationals are practicing “barge economics”—a moniker inspired by former General Electric CEO Jack Welch, who once said he wished he could put his factories on barges and move them to whatever country had the best conditions. With today’s trade deals, says Palley, “we have given the official blessing to institutionalizing the race to the bottom that barge economics produces.”

This stuff isn’t easy. The Pacific and Atlantic trade deals are the product of years of painstaking negotiations. A President Trump won’t be able to dictate new terms to trading partners, no matter how good a dealmaker he is. The WTO would probably strike down his threatened 45 percent tariffs on Chinese imports as an unfair trade practice. Rejecting the WTO’s authority could trigger a multisided tariff war that would hurt the U.S. as well as its trading partners. What’s more, “if we did China-specific sanctions, the trade would just divert to Vietnam, etc.,” says Douglas Irwin, an economist and free-trade advocate at Dartmouth College.

A century ago, remarkably enough, free trade was the populist position. In 1911, The Tariff in Our Times, a book by the muckraking journalist Ida Tarbell, argued that high tariff walls protected capitalists, not workers. Sheltered from competition from Europe, she wrote, oligopolies could get away with selling expensive, shoddy goods in the U.S. market, harming consumers. High tariffs on wool were even keeping tuberculosis patients from getting warm woolen clothes and blankets, she wrote. She condemned congressmen who voted repeatedly for high tariffs: “We have developed a politician who encourages the most dangerous kind of citizenship a democracy can know—the panicky, grasping, idealless kind.”

The world has changed a lot since then. Populists have lost their taste for free trade. But Tarbell remains correct. If the government can get over its panicky, grasping, and idealless ways and do what’s right, trade can be an engine of prosperity and a weapon against entrenched economic power.