Cambodia and EBA deal : Challenges and responses

Khmer Times | 30 January 2020

Cambodia and EBA deal : Challenges and responses

by Sek Sophal

The EU’s final decision to strip off its trade preference scheme known as Everything but Arms (EBA) from Cambodia will be made in February 2020. It will come into effect in August should Cambodia fails to comply with the EU’s rigid demands for the unconditional dropping of all charges against former opposition leader Kem Sokha along with his party activists, restoration of the Cambodian National Recue Party (CNRP) and the promise of media freedom.

Obviously, Cambodia does not want to lose its EBA status. A special Cambodian envoy was sent to discuss the issue with the European Commission and the Ministry of Foreign Affairs and International Cooperation has worked hard to coordinate responses to the EU. However, there is not much Cambodia can do more to maintain its EBA status. A question arises as to how Cambodia will effectively respond to the upcoming challenges after the EU revokes Cambodia’s EBA status next year ?

The EBA has played an important role in Cambodia’s economic growth and development for years. According to the official website of the European Union, the EU-Cambodia’s bilateral trade volume in 2018 was about $8 billion. Accounting for 17.3 percent of Cambodia’s total trade, the EU ranked the second largest trade partner of Cambodia after China. Losing the EBA privileges, according to a leaked document by the Ministry of Commerce published by a Phnom Penh newspaper in 2017, would cost Cambodia $676 million in tariffs.

Even though the EU’s market is of great significance, the Cambodian government has downplayed it, stating that the EBA deal is not everything. Cambodian thinks losing the EBA agreement will weaken Cambodian economy, but not necessarily lead to the failure of the whole economic system. Prime Minister Hun Sen has repeatedly appealed to the government officials and the public to be ready for the possible suspension of the EBA status. Totally complying with the EU’s conditions is, as Prime Minister Hun Sen argued recently, tantamount to losing Cambodia’s national sovereignty.

Within this context, it is apparent that Cambodia would prefer letting the EBA status go rather than complying with the EU’s conditions. If the EU withdraws the EBA status, Cambodia will still be able to export its garment products to the EU market as long as it can pay off the tariff. Ken Loo, secretary-general of the Garment Manufacturers Association in Cambodia (GMAC), said during an interview in late September 2019, “We will still be able to export to the EU, albeit without any trade preferences.

[But] this means that we will be less competitive price-wise as [producers of] Cambodian products will be required to pay the prevailing import duties.” While Loo’s argument is logically right, this strategy is short-term only. It is crucial to note that even though Cambodia still enjoys its lower labour and production costs, the tariff amount imposed by the EU will certainly decrease the price competitiveness of the Cambodian exporting products in the long run. If that is really the case, it is highly unlikely that Cambodia can stay in the EU’s market for the long run.

Coping with the post-EBA challenges needs a set of long-term strategies. Diversifying the export markets is a strategy of choice. The latest political development indicates the Cambodian government might have already started re-calibrating its export strategies. Cambodia has been actively looking for alternative markets in China, South Korea and the Eurasian Economic Union (EAEU) in recent months. Cambodia has already kicked off its free-trade agreement (FTA) negotiations with the EAEU since early 2019.

The EAEU, according to Tek Reth Kamrong, secretary of state at the Ministry of Commerce, has so far agreed to provide tariff-free accesses for 46 Cambodian-made products for the period of three years. The total population of the EAEU is 183 million, meaning that market size is pretty big for Cambodia. “Every new market,” as Kamrong told the Phnom Penh paper on March 22, 2019, “is always a potential”. The negotiations are ongoing. The specific timeline to conclude the FTA, however, remains unknown.

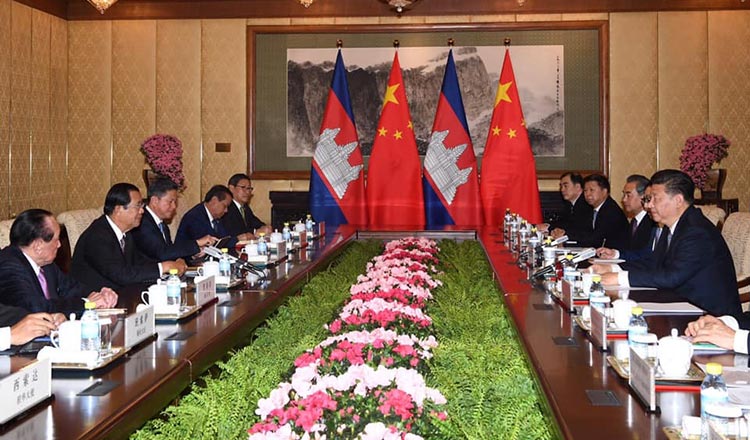

Besides the FTA negotiations with the EAEU, Cambodia has started to negotiate other FTAs with China and South Korea. Cambodian and Chinese officials met in Beijing in December to discuss the feasibility study, which could pave the way for Cambodia-China FTA negotiations in the near future, and will meet again in April in Siam Reap. Similarly, during the first Mekong-Republic of Korea Summit on Nov 27, 2019, in the city of Busan, South Korea’s Trade Minister Yoo Myung-hee and Cambodia’s Minister of Commerce Pan Sorasak signed a deal to start the study of Cambodia-South Korea FTA.

Cambodia has made efforts to minimise the vulnerabilities of market dependence on the EU, yet it is not enough. The possible withdrawal of the EBA deal still poses several long-term consequences for Cambodia. While diversifying the markets is a good strategy of choice, the FTA talks are technically complicated and time-consuming. The FTA talks between Cambodia and the EAEU, as the Ministry of Commerce of Cambodia said in early December, are going smoothly.

The tentative date the two parties will conclude the FTA, however, remains far from clear. Similarly, the Cambodia-China FTA and Cambodia-South Korea FTA still have a long way to go because Cambodia, China and South Korea have just started the feasibility studies of the FTA. Equally important, while the new markets have potential, the nature of those new markets and the purchasing power are different.

The population of the EAEU is about 183 million and its gross domestic product (GDP) in 2018 was $ 2.2 trillion, while the population and GDP of the EU in 2018 were 512 million and $18.8 trillion respectively. The EU’s market has far more potential than that of the EAEU. Domestic reforms to cut production costs and improve business and investment climate are the key solutions to challenges and of the post-EBA Cambodia. Independence and sovereignty cant be sustained and enhanced if we don’t have self-determination, economic self-reliance and resilience.

Sek Sophal is a research fellow at the Mekong Centre for Strategic Studies, Asian Vision Institute