Free trade and austerity: an explosive cocktail

Todas las versiones de este artículo: [English] [français]

Mediapart | 18 décembre 2014

Translated by Anoosha Boralessa (January 2016). Not reviewed by bilaterals.org or any other organization or person.

Free Trade and Austerity: An Explosive Cocktail

Author: ATTAC FRANCE

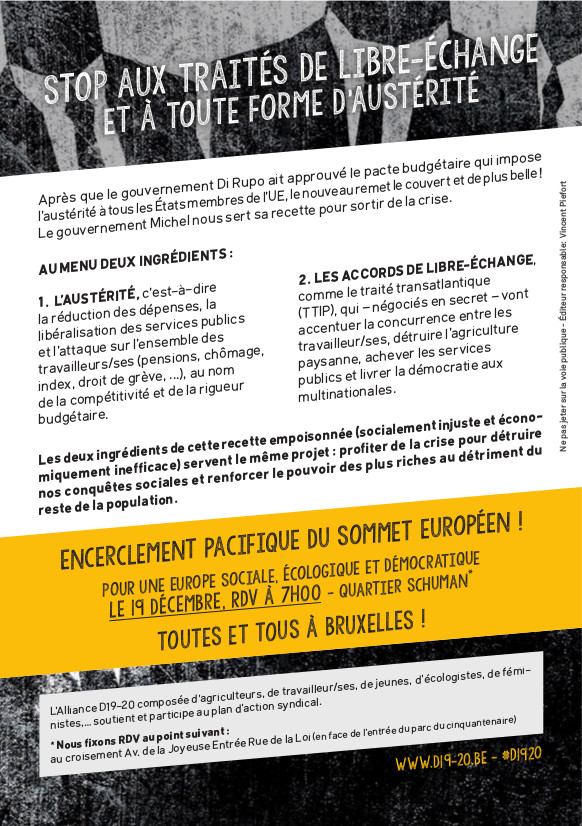

On 19 December 2014, thousands of Europeans will gather in Brussels to surround the European Summit of Heads of State. This will mark their opposition to EU austerity and competitiveness, symbolized by the memoranda imposed on the Club Med Countries as well as the draft transatlantic agreements, CETA and TAFTA.

« Austerity or chaos » - this is the message that European leaders have been hammering home since the 2008 crisis. It is testimony to the totally outrageous and unprecedented support that the European Commission has clearly signalled to the pro-austerity candidate in the Greek presidential elections. While Syrizia could very well win the forthcoming elections with its anti-memorandum programme, «the Greeks know very well what a bad election result would mean for Greece and the Euro Zone» Jean-Claude Junker, the President of the Commission threatened during a recently televised debate.

Everywhere in Europe, this flight to austerity is provoking recession and social cutbacks. But the sycophants of austerity assure us that we can unite to find our way out of this “serious budgetary” crisis». The miracle solution? «Competiveness»: by multiplying advantages for investors and their multinationals, European leaders hope to produce a flurry of private investments … and this against the devastating effects of budgetary cuts on the European economy.

However, the cocktail of austerity policies and competition policies is a long way off from achieving hard results. The pro-private investment measures, have contributed less to a return to growth and more to the explosion of big business profits [1]. All this puts a heavy strain on the public coffers. And as for the budgetary cuts - these have not allowed a return to a balanced budget. On the contrary, they have plunged indebted countries into a destructive spiral of deficits and recession.

Signing the transatlantic agreements between the EU and Canada on the one hand (CETA) and EU and the United States on the other hand (TAFTA), could cast the dye for a new stage for implementing this disastrous cocktail.

TAFTA and CETA: Treaties for Multinationals

Under negotiation from July 2013, free from the citizens’ prying eyes, the free trade treaty TAFTA (TransAtlantic Free Trade Area) is, like CETA, symbolic of the policy implemented in the European Union since 2006 and the “Global Europe” [2] strategy: to give once and for all, investors and multinationals the keys to the economy. The expectation is that their profits will create growth and jobs tomorrow. Incidentally, the negotiation process of the EU-Canada treaty began before TAFTA and its ratification process should begin in 2015.

TAFTA and CETA are not satisfied with making the social systems and environmental and health regulations on both sides of the Atlantic compete, all in the name of sacrosanct trade. They want to institutionalize the role of lobbies through regulatory cooperation mechanisms and to set up a private justice system tailored for multinationals [3]. Thus, their claim is to assert that investors’ interests trump democracy and this will render the exit from neoliberalism infinitely more costly.

The governments, the European Commission and the lobbies declare that these agreements will be dictated by economic needs - in the form of austerity policies. However, even the European Commission’s biased impact studies indicate very modest results for TAFTA: a 0.5% increase in the European GDP in the most optimistic scenario…over a period starting now and ending in 2027 [4].

But even the prediction of these insignificant gains has been rubbished by other studies. The US University, Tufts, has recently published a report [5] finding that increased competitive pressure between the EU and the US, would contribute the following to Europe: a net loss in terms of GDP, average salary decreases, elimination of jobs and increased financial instability.

TAFTA, like CETA, could thus contribute to a deflationary spiral where budgetary cuts and accumulation of revenues, stimulate the European economy but at the same time reinforce the political clout of multinationals. Provoked by irrational Finance and excessive deregulation, the crisis is used to justify dogmatic austerity and competition policies… which contribute to them returning in a more virulent form.

To Resist and To Reinvent

Faced with the explosion of inequalities, faced with the threats that free trade treaties and even more austerity burden on our societies, it is time to move to a counter-attack. We must break with TINA [5] and develop another image - one that holds democratic, ecological and social alternatives. Multinationals and finance have to be reigned in. A first step would be move to a powerful mobilization of European and transatlantic citizens that will succeed in saying “no thanks” to CETA and TAFTA.

On 19 December at Brussels, by surrounding the European Summit, social movements are demanding big political changes. For the people and the environment against the diktat of short-term profit, the influence of multinationals and ecological disasters, it is now passed the time to change the order.

Frédéric Lemaire

[1] http://business.lesechos.fr/directions-financieres/0203710818121-bourse-les-dividendes-volent-de-record-en-record-102440.php

[2]http://europa.eu/legislation_summaries/external_trade/r11022_fr.htm

[3] The investor state dispute settlement mechanism (ISDS) would allow investors to attack states before private arbitral tribunals, if they consider that protectionist measures on health, environment and financial regulation harm their profits. The mechanisms of regulatory cooperation (taking the form of fora or councils) would provide lobbies with increasing influence in drafting new regulations.

[4] http://www.guengl.eu/uploads/publications-documents/ASSESS-TTIP-%C3%96FSE_-_fr.pdf

[5] http://ase.tufts.edu/gdae/policy_research/TTIP_simulations.html