WITA | 23 March 2015

Investor-State Dispute Settlement promotes American values

By Stephen M. Schwebel

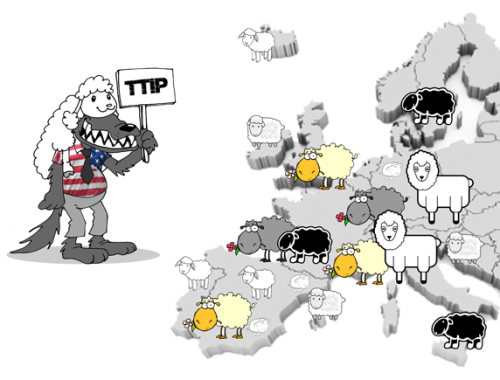

U.S. investment protection treaties, which promote international investment while providing for protection of that investment, reflect our constitutional commitment to individual rights, further the resolution of disputes by rule of law, and guard against arbitrary government conduct. These reciprocal agreements are vital to the rules-based economic system but have been increasingly criticized by certain interest groups as posing a threat to legitimate government regulation. Some politicians appear to agree, arguing that the so-called investor-state dispute (ISDS) mechanism should be excluded from U.S. agreements now under negotiation with Europe and with countries of the Asia Pacific region.

Are the critics correct? Should the United States drop ISDS from its existing and projected trade and investment agreements? The answer must take into account the nature and scope of the rules enforceable through ISDS.

For three decades after World War II, these rules were the subject of vigorous international debate. On the one hand, the United States and its European allies argued that international law accords foreign investors certain minimum standards of treatment. On the other hand, the Soviet bloc and some developing countries maintained that foreign investors were owed no greater protection than was available to their own citizens under their domestic law, however insufficient or inexistent.

The Western view ultimately prevailed, forming a global consensus now reflected in more than 3,000 investment agreements — mainly bilateral investment treaties — worldwide. These agreements run not only between developed and developing countries but also between developing countries (which can hardly be thought to be solicitous of the interests of multinational corporations). The provisions of those agreements, including the obligation to compensate investors in the event of expropriation and refrain from arbitrary treatment and nationality-based discrimination, are strikingly similar in their scope and content. The availability of ISDS to enforce those obligations thus represents the triumph of the rules reflected in the U.S. Constitution.

It is incorrect for critics to argue that ISDS accords foreign investors in the United States “greater rights” than are available to U.S. investors. In fact, the investment protections enforceable through ISDS are fully consonant with the rights guaranteed by the Fifth Amendment. Those rights include protection against arbitrary or discriminatory governmental actions and the right to receive just compensation when governments discriminate against foreign investors or expropriate foreign investments. Given the consistency between the international and U.S. standard, it is not surprising that the United States has rarely been sued and never lost an ISDS case.

Because these rights inhere in U.S. law, foreign investors in the United States enjoy such rights, with or without a treaty, and can count on the independent U.S. judiciary to enforce those safeguards. But without investment treaty rules, U.S. investors abroad may be subject to lower standards and are left to the mercy of local courts and governments that may be biased or corrupt. Even when the United States is negotiating with democratic partners where judicial remedies are generally effective, ISDS provides an important safeguard against discriminatory treatment arising from a desire to protect favored domestic interests or from anti-foreign bias.

Critics contend that ISDS infringes governments’ sovereignty and is biased in favor of investors. In fact, the standards of treatment and the procedures governing disputes are set forth in treaties that governments negotiate and freely enter into based on their assessment of the benefits of protecting the investments of their nationals and attracting investment from abroad. The composition of ISDS panels helps to ensure a fair hearing of the government’s as well as the investor’s case. The two parties to the dispute have an equal role in the selection of the arbitrators, who are subject to rules to ensure independence and impartiality and protect against conflict of interest.

Governmental interests are further protected by current ISDS procedures, including a mechanism to dismiss frivolous claims, permit amicus submissions and increase the transparency of arbitral proceedings. The high level of deference to legitimate government regulation apparent in the decisions of ISDS panels demonstrates that charges that they are biased in favor of corporate interests, or that they “chill” the ability of governments to regulate in the public interest, are unfounded. The fairness to governments of these proceedings is indicated by their outcomes: two-thirds of tribunal awards found in favor of the government, while just one-third found in favor of the investor, according to a recent study of cases under the World Bank’s International Centre for Settlement of Investment Disputes.

The arguments against ISDS are not new, and they are no more persuasive for having been adopted by certain political leaders in Europe and the United States. ISDS, and the obligations it enforces, reflect decades of American leadership in shaping global rules that promote economic freedom and sustain the international rule of law. President Obama is right to protect that legacy.

Written by Stephen M. Schwebel – Former Judge and President of the International Court of Justice.