Fourteen years of NAFTA and the tortilla crisis

Todas las versiones de este artículo: [English] [Español] [français]

Fourteen years of NAFTA and the tortilla crisis

Ana de Ita

August 2007

In January 2008, agricultural trade between Mexico, the US, and Canada will become completely free, with the end of the implementation period of the North American Free Trade Agreement (NAFTA). All US and most Canadian products [1] will be able to enter Mexico without any duties. The same will occur with Mexico’s exports to the other two countries. NAFTA’s agricultural agreement (Chapter VII) promotes the total liberalisation of agriculture and forestry in the region. NAFTA commitments related to agriculture between Mexico and the US are the most radical of any trade agreement, since they include the liberalisation of all agricultural and agrifood trade over a maximum period of 14 years. NAFTA is the first treaty to treat two developed countries and an underdeveloped one as equals. But compared to US and Canadian agricultural sectors, Mexico’s presents huge asymmetries in terms of economics, technology, production factors, and agricultural policies and supports.

Even before signing NAFTA, 75% of Mexico’s agricultural exports went to the US and 69% of its imports came from the US. [2] Because of the much smaller size of the Mexican economy, the US market is much more important to Mexico than vice-versa: Mexico provided only 12% of total agricultural imports going into the US and bought just 7% of US exports. Mexico is also more heavily dependent on Canada than vice-versa: Canada’s agricultural exports to Mexico amount to 28% of its total agricultural exports, whereas Mexico’s exports to Canada are 8% of Canada’s imports.

NAFTA negotiations took place without taking into consideration the views of Mexico’s civil society. The inclusion of the agricultural and forestry sectors was one of the most controversial topics, due to profound asymmetries between Mexican agriculture and that of the US and Canada. In 1989, Mexico began an agricultural modernisation process via “kicks and blows from the market.” The objectives that drove agricultural policy were the opening of trade, withdrawal of the State from the majority of its economic activities, reduction in subsidies, and the privatisation or elimination of most state-run enterprises. All the neoliberal reforms undertaken meshed with NAFTA, which in 1994 became “the lock that secures the door and blocks the reversal of the reforms”. [3] It is practically impossible to separate the effects of the reforms from those of NAFTA. The US promoted NAFTA as a security measure in its relations with Mexico and Canada, in order to reinforce economic stability in both countries and to guarantee the permanence of policy and trade reforms achieved since the mid-1980s. [4] According to the US Department of Agriculture, one of the main benefits of the treaty was to prevent Mexico from feeling tempted to turn to protectionist policies during the peso crisis of 1995. [5]

NAFTA guaranteed that the drastic structural reforms imposed on agriculture would be maintained for 14 years and become institutionalised agricultural policies, despite the devastating effects on producers, especially rural farmers. Mexico is a historical example of the effects of agricultural liberalisation when it is imposed “by hook or by crook” in an international agricultural market organised around state protection and subsidies: prices are equalised, despite differences in production costs, performances, or agricultural subsidies, and deliver extraordinary profits for those who can produce at the lowest cost.

Effects of NAFTA’s agricultural agreement: 1994-2006

Foreign trade and economic growth

Designers of neoliberal policies assume that an increase in international trade produces greater economic development and that the opening of trade creates profits for all actors in the areas in which they have comparative advantage. [6] Nevertheless, deep asymmetries between agriculture in Mexico vis-à-vis the US and Canada, in general terms, means that the main productive sectors - basic grains, oilseeds, forestry, and livestock (with the exception of poultry) - enjoy no advantage over the competitors.

Before 2003 Mexico had special safeguards for the import of live hogs, pork, hams, lard, bacon, fowl, chicken and turkey meat paste, eggs, potato products, fresh apples, coffee extract, and orange juice. The US could apply special safeguards for horticultural products during certain seasons. Safeguards could be triggered when imports exceeded the defined quotas and authorised the application of the tariff in use prior to NAFTA. [7] Most agricultural products were liberalised in 2003, but “sensitive” products, which for Mexico are corn, beans, and non-fat dry milk, enjoyed “extraordinary” protection until 2007. Yet Mexico’s government decided to favour importers, and for many years did not take advantage of the protection to which these products were entitled. In January 2008 imports of sugar and high fructose corn syrup are also to be freed: these products, along with chicken legs and thighs, were the subject of a trade dispute at the WTO and obtained special safeguards from 2003 to 2007. At the same time, the US is supposed to allow the import of broccoli, cucumbers, asparagus, melons, watermelons, sugar, and orange juice, which are still protected. Sugar was the subject of a final negotiation through parallel agreements which eliminated the advantages for Mexican exports to the US. The end of the transition period means the end of the period during which it will be possible to establish bilateral safeguards that come into play when one party proves that imports from another party causes damage to the national industry. [8]

Agricultural foreign trade has increased almost threefold since the trade opening. Because Mexico had begun a unilateral process of opening its agricultural sector from the mid-1980s, [9] between 1993 and 2002 imports grew faster than exports (with an average annual growth rate of 7.3% compared with 4.4%), and it was only after 2003, at the end of the 10-year period of tariff reduction, that Mexican exports increased and closed the gap. Since NAFTA, Mexico has become the third largest market for US agricultural products. The trade balance in agricultural and food products has been negative for every year of NAFTA except 1995, when agriculture gained a positive balance thanks to the devaluation of the peso and the recession that functioned better than any tariff. Imports dropped from US$3 billion in 1994 to US$2.5 billion in 1995. The surplus lasted until inflation caught up with devaluation, and from 1996 the agricultural balance again became negative.

Between 2001 and 2004 the agricultural trade deficit averaged several billion dollars a year. However, in 2005 there was a significant reduction in the deficit (by US$385 million) and it dropped even further in 2006. Mexico’s deficit in food trade, which under NAFTA has averaged around US$1.3 billion, rose in 2001 to over US$2 billion. In 2003 it reached US$2.7 billion. After 2004, at the end of the transition period for most products, the deficit began to shrink as a result of the opening of US and Canadian markets to Mexican exports. The value of exports rose 70%, while imports grew 42.5% between 2003 and 2006. However, growth in agricultural foreign trade has not led to high growth in the sector as a whole, as assumed by neoliberals. Indeed, growth in the agricultural sector, which had averaged 2.5% between 1989 and 1993, fell to 1.9% under NAFTA. In both periods the agricultural sector grew less than the economy at large (3.1% and 2%, respectively), but the gap widened after 1995. The agricultural sector reduced its participation in the overall Gross Domestic Product (GDP) from 5.8% in 1993 to 5% thirteen years later.

The population working in the primary sector (agriculture, livestock, forestry, hunting, and fishing) fell drastically, from 8.2 million people in 1991 to 6.1 million in 2006. [10] This was intended by the authors of neoliberal policies, who believed that national development depended on a reduction in the size of the population working in the agricultural and forestry sectors. Those working in the primary sector represented 26.8% of the total working population in 1991 but only 14.6% in 2006. According to a study commissioned by the government, the number of agricultural households diminished from 2.3 million in 1992 to 575,000 in 2002, and those with mixed incomes dropped from 1.5 million to 900,000 over the same period. [11] Mexico’s inability to compete with the US in the agrifood sector has spurred the recurrent migration of farm workers and threatens to eliminate the future generation of farmers.

Agricultural trade exchange and food sovereignty

NAFTA was established to give each of its parties an opportunity to increase international trade in the agricultural products in which it enjoyed “comparative advantages” and thus to reduce its trade deficit. The US and Canada are two of the largest and most efficient exporters of grains in the world, while Mexico is a competitive exporter of horticultural and fruit products. However, this does not imply a complementary relationship between the sectors in the region. For Mexico, the treaty negotiation meant a change in the pattern of its crop selection.

Only 12.3% of Mexico’s land is devoted to arable agriculture, while about 54% is used in cattle ranching and another 26% in forestry. Of the arable land, 71% is used in the cultivation of basic grains and oilseeds. In general terms, Mexico has no comparative advantage over the US in cattle rearing, basic grains, oilseeds, or forestry. Fruit, vegetables, and tropical produce such as pineapples, sugar cane and coffee are the only products in which Mexico might have some advantage, but fruit accounts for only 6% of arable land, and vegetables 3%.

Mexico has 3.1 million producers, of whom 85% are farmers with plots smaller than 5 hectares [12.4 acres], and whose main crops are grains and oilseeds. [12] Only about 500,000 producers cultivate vegetables and fruit. Most of these are medium or large holders, because the heavy investment required puts this activity beyond the reach of smallholders. Mexico’s food trade with the US is based on the import of basic foodstuffs - corn, soya, rice, wheat, milk, oils and fats, beef, pork, and chicken meat - and the export of tomato, pepper, fruit and vegetables, cattle feed, shrimps, and, above all, beer and tequila. In 2006 four products accounted for 73% of Mexico’s agricultural exports: tomato, vegetables, fresh fruit and live beef cattle. And in the same year another four products made up more than half of Mexico’s exports of foodstuffs: beer, tequila, shrimps, and canned fruit and vegetables. Beer and tequila accounted for 26% and 10%, respectively. By 2006 exports of beer, a relatively new product, had risen to US$1.138 billion, while sugar and orange juice, considered winners in the NAFTA negotiation, had lost importance, with their share of exports dropping from 11.7% and 5.3%, respectively, to only 2% and 1%. Corn, soya and oilseeds, sorghum, wheat, rice, and cotton accounted for 60% of the country’s agricultural imports. Corn imports rose exponentially under NAFTA. The most imported foodstuffs were: beef, pork, poultry meat, dried milk, oils and fats, cereals, malt, and malt extract. Under NAFTA, US pork producers increased their share of the Mexican market by 130%, and Mexico’s imports of beef and veal quintupled. So while agricultural and food exports from Mexico are concentrated in a small number of lavish products for the US elites, Mexico has lost its ability to feed its population and has increased its dependency on the import of basic goods.

Integration of markets: concentration and displacements

NAFTA has led to concentration and regional integration. In Mexico, with no state regulations or state protection, many small farming units have gone under, unable to compete with the imports that flooded the domestic market. Larger producers, better off in terms of land, irrigation, resources, and credit, have taken advantage of the opening to modernise and absorb a larger proportion of internal markets.

The Mexican government eliminated state regulatory agencies in the agricultural sector. The vacuum left by the state was filled by TNCs, subsidiaries of US corporations, many of which created links by mergers or stock acquisitions in the strongest Mexican companies. The integration within the US market through the TNCs has occurred on an unprecedented scale. It was carried out in different ways, according to the type of production, but in all cases it involved state mediation of a transfer of income from the farming to the business sector. Producers of tomatoes for export in Sinaloa, one of the few successful sectors under NAFTA, established formal relationships with producers in Florida, USA, collaborating closely with them, but they also displaced small family producers from Mexico’s central states, who formerly supplied the internal market, now controlled by the Sinaloans .

Markets for basic grains such as corn, wheat, rice, and soya are controlled by a very few transnational enterprises, subsidiaries of US companies, that work on both sides of the border. Besides influencing prices for producers and participating in imports, they can act as monopolies, as they did during the 2007 tortilla crisis. After the 1995 economic crisis, which bankrupted most small cattle and poultry farmers, domestic production of beef cattle, pork, and poultry was modernised and concentrated in a handful of large companies, many of them US-based TNCs. The Mexican government decided to support them by dismantling the protection previously given to the producers of basic grains, which is one of the main inputs of the livestock producers. This accelerated the integration of the livestock producers within the integration of the North American regional market.

Foreign direct investment

One of the main commitments in NAFTA was “national treatment” for foreign investors (Chapter XI), which forced Mexico to change its legislation on investment. NAFTA strengthened the rights of foreign investors to retain profits from their initial investments. Neoliberal policymakers made foreign direct investment (FDI) the engine of economic development, but, despite the reforms, little additional foreign investment was made in farming. According to official data, FDI in the agricultural sector totalled US$10.8 million in 1994, while by 2004 it had reached only US$16.3 million. [13] At the beginning of NAFTA the sector was absorbing only 0.1% of total investment and, by 2004, even less, 0.09%.

NAFTA has encouraged greater FDI in the area of foods and beverages, half of which comes from the US. In 2005, direct US investment in Mexico’s food processing industries reached US$2.9 billion, while Mexican investment in similar industries in the US was US$1 billion. [14] Even more importantly, food sales in Mexico associated with US direct investment rose to US$6 billion in 2003, more than the value of food exports from the US to Mexico. [15] The main US food brands are sold in Mexico. In intermediate products US investment plays an important role in flour milling, grain trading, and meat processing. A few of the larger Mexican food companies have also strengthened their presence in the US market, such as Gruma in the corn flour and tortilla market. The main US-based TNCs have strengthened their presence in Mexican farming, and their share of the internal market has grown as they have taken over important portions of the markets in corn, soya, wheat, rice, poultry meat, eggs, and pork. The world agricultural and food market is highly concentrated, and processes of vertical and horizontal integration have been of great importance since the 1980s.

Balance by products: basic grains and oilseeds

For Mexico NAFTA meant sacrificing national production of basic grains in exchange for access to new markets for vegetables and tropical fruit. Producers of basic grains and oilseeds have lost heavily from NAFTA’s agricultural chapter. Between 1991 and 2001, the number of basic grain producers dropped by a million, from 4.1 to 3.1 million. [16] At the same time there was a fall of 852,000 hectares [2.1 million acres] in the amount of land devoted to these crops between 2000 and 2005. [17]

Mexico is a net importer of food. More than 80% of its arable and meat imports are basic grains, oilseeds, and their derivatives. Imports have constantly increased under NAFTA, more than doubling by 2006. Mexico spends an average of US$4 billion annually on imports of basic grains and oilseeds. Mexico is the main market for the export of cotton and sorghum from the US, the second market for corn, after Japan, and the third market for wheat and soya. The opening of the market meant additional competition on the domestic market, leading prices to fall. Since the 1989 reforms, the domestic prices of grains have dropped by 50%.

In NAFTA, the Mexican government agreed to liberalise its basic grains and oilseeds market over a ten-year period, which ended in 2003. An exception was made for corn and beans, which were allowed protection until 2007. For rice, a tariff of only 10% was originally established, to be phased out altogether by 2003. Before the opening, four out of every ten tons of rice produced in Mexico were exported, but by 2006 seven of every ten tons of rice consumed were imported. Production dropped by almost a half, and most of the small producers went bankrupt, as domestic prices fell by 55% between 1989 and 2006. NAFTA negotiated the immediate liberalisation of the seasonal tariff of 15% on sorghum, the main cattle feed. Sorghum production suffered a drastic fall with the elimination of its protection, but after 1997 it began to recover and reached pre-opening levels. The increase in sorghum demand from cattle rearing has been covered by imports. Currently, a third of national consumption comes from imports. As a result, sorghum prices dropped by 57% between 1989 and 2005. By 2006, they began to recover, pushed by the rise in international prices for corn. Wheat was the only product that performed competitively with US production. It enjoyed protection from imports due to a previous permit, which was replaced at the beginning of NAFTA with a tiny tariff of 15%, to be gradually reduced and eliminated by 2003. Wheat imports went from absorbing 9% of national consumption before the 1989 opening of trade to more than half in 2006. Wheat stopped generating income for many producers, and production dropped by 27% as a result of the 48% decline in wheat prices, pressured by imports.

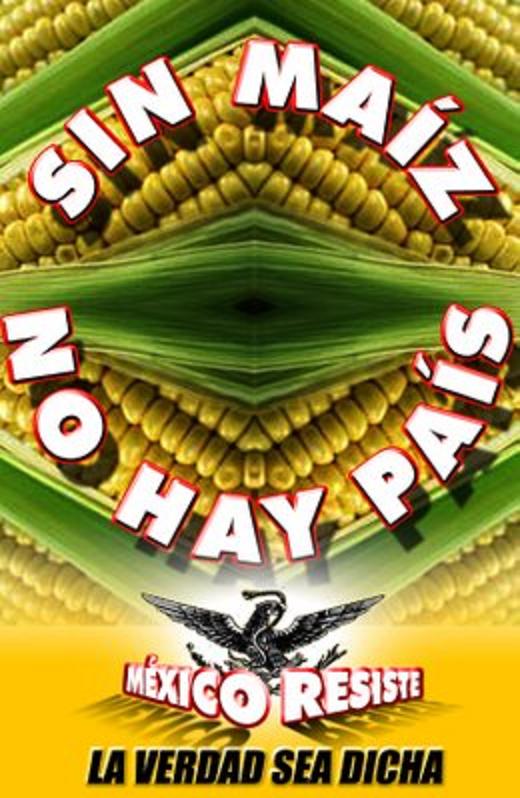

Corn

The case of corn (maize) under NAFTA is paradigmatic, as it illustrates the behaviour of the government and TNCs that have benefited from liberalisation. Corn is the most important crop in Mexico in terms of the volume of production, cultivated land, production value, and number of producers. During NAFTA negotiations - based on the theory of comparative advantage - corn was one of the main problems, because it could not compete against US and Canadian production. From the viewpoint of the policymakers, the activity of 85% of the producers with less than 5 hectares [12.4 acres] of farmland was not competitive; 4.7 million hectares [11.6 million acres] should be converted to other crops, with a loss of 7.1 million tons of corn produced on that acreage. Small-scale corn farming was supposed to disappear, although it constituted half the national production, and half of it was marked for local consumption.

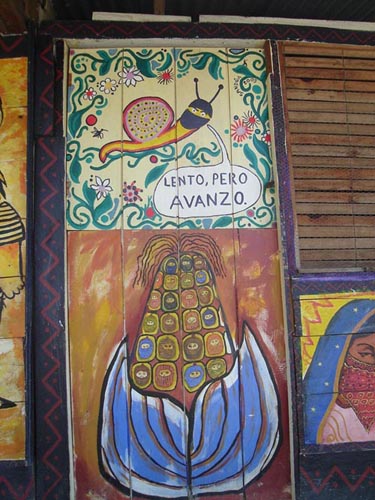

Reality turned out to be different from the theory. From 1989 other grains (apart from corn) and oilseeds had suffered a process of opening and deregulation. As a result, Mexican agriculture underwent a phenomenon of “cornification”, stimulated by the lack of protection for other crops. Corn production between 1989 and 1993 rose by 65%, from 11 million to 18.1 million tons. The main increase occurred in irrigation areas in states of the north-west, mainly Sinaloa, traditionally devoted to commercial crops, mainly for export. The land devoted to corn in non-irrigation areas remained relatively constant. Without the support of civil society, the Mexican government agreed to the liberalisation of corn in NAFTA. According to the assumptions that underpinned NAFTA, the trade opening would force farmers to switch to crops with greater competitiveness on the international market. Under NAFTA, protection for corn was negotiated through tariff-quotas and a long period - 15 years, the longest permitted - was allowed for gradual adaptation. The 15 years, which end at the beginning of 2008, should have allowed producers to adjust to an open economy. [18] But corn production has not fallen during this period; it has increased, and currently stands at over 20 million tons. These indicators suggest that there were no other production alternatives for the new generation of corn farmers in the 1990s.

Corn imports under NAFTA

Corn is the net loser in the NAFTA negotiations for agriculture. After 14 years in operation, the supposed extraordinary protection for corn has been systematically eliminated since 1996 (with the exception of 1994 and 1997), due to a unilateral decision by the Mexican government. For corn production, there has been no period of transition, because in fact it has already been operating as an open market. Corn imports systematically exceeded the negotiated quota, and the extra imports were not charged the corresponding tariff. As a result, 3.2 million producers, the majority of the small-scale producers in the country, were denied the promised protection. The increase in imports was not due to a lack of production or higher domestic prices than international prices. For several years prices paid for imported corn were higher than Mexican corn. The heart of the matter can be found in the support programmes for agricultural and livestock exports that the US government provided to its producers through the Commodity Credit Corporation (CCC). [19] Through this programme corn importers could obtain long-term soft loans. Importing grain became a profitable financial operation. [20]

In just a year, between 1995 and 1996, corn consumption increased by 3 million tons. Up to 1990 farmers could not feed corn to livestock, as it was regarded as a staple food for the population, but this ban was lifted in 1996, and the livestock sector became the main destination for imported corn. Grain consumers [21] gained political power needed to influence agricultural and trade policy: they avoided paying the tariffs permitted under NAFTA for corn imports above the quota. The Mexican government effectively practised dumping against its own national corn producers by eliminating the tariffs designed to protect their production. Small farmers were forced to bear a huge burden in order to benefit importers, among them some of the world’s largest TNCs.

In 1999 the Mexican government eliminated the state-owned enterprise CONASUPO (National Company of Popular Subsistence), which had the responsibility to regulate the basic grains market in support of producers and consumers. Corn was the one product that after NAFTA was still sold by CONASUPO. CONASUPO’s closure left producers in the hands of a very small number of large TNCs, the only buyers of their harvests: Maseca, Minsa, Cargill, Arancia, and Archer Daniels Midland (ADM). These companies are also the US’s main importers and principal exporters; Cargill, ADM and Zen Noh control 81% of corn exports in the US. [22] In recent years they absorbed a good portion of the subsidies that the Mexican government handed out for marketing corn surpluses. The private corn market grew rapidly, as the TNCs strengthened their integration, at the cost of producers. When restrictions were eliminated, exports from the US increased dramatically. The majority of the exports are of yellow corn, used as cattle feed. Exports of white corn for human consumption are not significant and even went down after 2000. The broad access to US corn reduced domestic prices for corn by 59% between 1991 and 2006, to allow for the expansion of the poultry and pork industries. The two largest Mexican companies in the corn flour industry - Maseca and Minsa - have positioned themselves in the domestic and foreign markets.

In 2001 189 companies imported 6.1 million tons of corn, a record amount. [23] The livestock sector absorbed 47.1% of this, of which companies that produce balanced feed for cattle absorbed the highest percentage, while fatteners acquired only 4%. The starch sector absorbed 31.2% of imports, and within that Arancia-Corn Products International led the pack as a corn importer. The flour sector acquired 11% of imports and of these Maseca got the largest portion. Diconsa, all that was left of CONASUPO, absorbed 3.7% of imports instead of fulfilling its social function of supporting direct purchases from national producers. Starting in 2003, owing to the pressure of farm organisations in the “Countryside can’t take it any more” movement and public opinion, Diconsa stopped importing corn and bought only from national producers, once it was proved that the company had played a role in the genetic contamination of native corn. [24] Half of the imports in 2001 were bought by nine large Mexican or US companies: Arancia-Corn Products International, Minsa, Maseca, Archer Daniels Midland (ADM), Diconsa, Cargill, Bachoco, Pilgrims Pride and Purina. Several of these are linked to each other through associations or co-investments in a process of concentration and constant integration. Primary distribution and processing of grains are the links of the world food supply chain that are most concentrated. [25] Three of the leading world cartels operating in the commercialisation sector of basic grains operate in Mexico: Cargill-Continental; ADM-Maseca and Minsa-Arancia-Corn Products International. Diconsa imported usually through ADM.

The neoliberal tortilla crisis

At the beginning of 2007, there was a sharp increase (of between 42% and 67%) in the price of tortillas, which rose from 6 pesos to at least 8.50 pesos. This wreaked havoc on the purchasing power of wages. The tortilla crisis is an instance of the failure of neoliberal agricultural and food policies, championed by successive governments during the past 25 years. When dealing with corn in the import-substitution model, the state had promoted an agricultural policy that was geared to food self-sufficiency. To that end it had built a system of buying from farmers, and of storing, processing, marketing and distributing basic commodities. The CONASUPO system - an institution dating back to the presidency of Lázaro Cárdenas (1936-1941), created to prevent monopoly control and speculation around basic commodities - was initially the only, and then later the main, importer and exporter of basic commodities, in a closed economic system, where agriculture was protected by the requirement for prior authorisation for imports. It also had the role of managing a regulated reserve guaranteeing the supply of basic commodities for about three months. CONASUPO functioned as the main supplier to the mills and to the manufacturers of nixtamalised (pre-cooked) grain for making tortillas. The scheme allowed for price controls on tortilla, an important function in a country with very low wages. In this system producers were guaranteed a price for their products and consumers a maximum purchase price, and both prices were supported with subsidies.

But the neoliberal policies that NAFTA institutionalises modified the state’s core regulatory functions and eliminated the institutions that made regulation possible, starting from the premise that the market regulates itself. As part of NAFTA negotiations, before the treaty was launched, guaranteed prices were eliminated and CONASUPO was liquidated. Also in 1999 poor consumers received a severe blow because tortilla subsidies given to 1.2 million families were eliminated. The shortage of corn during the first months of 2007 was the product of three factors: (1) speculation by the large monopolies that dominate Mexico’s corn and tortilla markets; (2) NAFTA commitments to open up the agricultural and livestock sectors totally to imports from the US as of 1 January 2008, which in 2007 have resulted in increased dependence on US food imports; and (3) increase in corn prices in the international market due to the increased demand for corn to produce ethanol, which in an open economy greatly affects the domestic market.

The price rises were not due to a lack of national production, since in 2006 21.9 million tons were produced, a record output. At the same time record volumes of corn were imported - 7.3 million tons of yellow corn and 254,000 tons of white corn. If imports of broken corn are included, the total reaches 10.3 million tons. Bizarrely, in a year of crisis allegedly due to a decrease in the corn supply, corn stocks reached their highest volumes ever. Agribusinesses hoarded the 2006 and early 2007 harvest, claiming that there was a shortage of the grain at a time of rising international prices and low inventories, and they pushed up prices through speculation. These businesses made extraordinary profits because they bought corn at 1,450 pesos from the autumn-winter 2005-2006 harvest, which starts in April for producers in Sinaloa and Tamaulipas, and at 1,760 pesos from the producers of the 2006 spring-summer cycle, which starts in September, but at the end of December they were selling it at between 3,000 and 3,500 pesos, which naturally made the price of tortillas shoot up. They did not even have to pay the financial costs, nor those related to storage, since the subsidy programmes for trade in surplus, [26] operated by the Ministry of Agriculture, are aimed almost exclusively at major firms such as Cargill, Maseca, Minsa and Arancia, and gives them subsidies for guaranteed purchase, storage, handling, freight, shipping and export. Peasant organisations protested at the way businesses used these programmes to “dry out” the market artificially, reporting that Cargill bought and stored 600,000 tons of corn in Sinaloa. [27]

The Ministries of the Economy and of Agriculture and ASERCA (Support and Services for Agribusiness) provided subsidy so that 1.5 million tons of corn from the autumn-winter harvest in Sinaloa could either be exported to the US, Central and South America, or be used as livestock feed by large companies such as Bachoco in Sonora. All this caused an artificial shortage of white corn for human consumption. In the US, as the result of an increase in demand for yellow corn for ethanol production, the area devoted to cultivating white corn was reduced, and TNCs based in Mexico took advantage of the situation to export white corn to its plants in the US and South America. According to official statistics, only 174,413 tons of corn were exported in 2006, [28] which leaves unanswered the question of where large volumes of corn ended up. During the 2006-2007 autumn-winter cycle, Cargill did not turn to Sinaloa to buy corn as it normally does, which suggests that they might already have had inventories of corn in their possession. The price of corn on the world market rose as a result of the increased demand for it in the production of ethanol, but this increase was not related to the price at which it was sold in Mexico.

The tortilla crisis led to a larger share of the market going to the two major cornflour producing companies, Maseca and Minsa. In Mexico tortillas are produced by two different methods. The traditional nixtamalisation process makes up half of the market (51%), and is performed by about three thousand small mills (many of them are currently Cargill customers). The remaining 49% of the tortillas are made with cornmeal. The cornmeal industry is highly concentrated in Mexico - only four companies dominate the market. The Grupo Industrial Maseca is the main one, with a 73% market share, and Minsa, Agroinsa and Harimasa account for the rest. Corn tortillas are mainly distributed in the large self-service stores like Wal-Mart. The tortilla crisis will expand the market share for cornmeal tortillas, because large companies and retail chains can reduce their profit margins and sell tortillas at a price 30% lower than the maximum price established jointly by the government and industry. Livestock producers who use corn as feed and who have benefited these past 14 years from the removal of protections to farmers, intend to raise the prices of meat, milk, eggs and chicken, all of which are staple foods because of the rising cost of corn.

During this last year of NAFTA’s transition period, TNCs that control the basic commodities market are showcasing their monopolistic capacities and acting against producer and consumer interests. The tortilla crisis shows that one of the NAFTA’s basic assumptions - that it benefits consumers, even if it sacrifices farmers - is a macabre fallacy.

Notas:

[1] NAFTA is composed of three treaties between: (1) the United States and Canada, (2) Mexico and the United States, and (3) Canada and Mexico. Canada excluded from its treaties dairy, poultry, and egg products, for which it retains a supply management system.

[2] Kenneth Shwedel, “El TLC y el cambio estructural” [FTA and Structural Change], in: Alejandro Encinas, Juan de la Fuente and Horacio Mackinlay, coords., La disputa por los mercados. TLC y el sector agropecuario (Mexico: Editorial Diana, 1992).

[3] Luis Hernández, “TLC, Corte de caja” [FTA: Stop and Assess], Cuadernos del Ceccam, no. 7 (Mexico, 1996).

[4] Terry Crawford and John Link, coords., NAFTA International Agriculture and Trade (Washington, DC: ERS, USDA, September 1997), p. 8.

[5] Crawford and Link, p. 7.

[6] Alejandro Díaz Bautista, “El TLCAN y el crecimiento económico de la frontera norte de México” [NAFTA and the Economic Growth of the Northern Border of Mexico], Revista Comercio Exterior, Vol. 53, No. 12 (Mexico, December 2003), p. 1090.

[7] SECOFI, TLCAN, Texto oficial, Artículo 703 [NAFTA, Official Version, Article 703].

[8] SECOFI, TLCAN, Texto oficial, Capítulo VIII [NAFTA, Official Version, Chapter VIII].

[9] Mexico entered the GATT in 1986, after which it drastically revised its policy of protection for national productive sectors.

[10] INEGI, Anuario Estadístico de los Estados Unidos Mexicanos [Statistical Yearbook of the United States of Mexico] (2006). To 2004, the data referred to the population older than 12 years of age, but for 2005, to those older than 14, which makes it difficult to compare recent years.

[11] José Romero and Alicia Puyana, Diez años con el TLCAN, las experiencias del sector agropecuario mexicano [Ten Years of NAFTA: Experiences of the Agricultural Sector in Mexico] (Mexico: El Colegio de México), p. 227.

[12] ASERCA, the number of producers according to the Procampo [subsidy program], 2001.

[13] Methods for reporting foreign direct investment in Mexico have varied, making comparison of different years difficult; however, and despite substantial variation in the period 1994-2004, foreign direct investment was never greater than US$93 million, according to the Economic Secretariat’s National Register of Foreign Investment (Secretaría de Economía, Registro Nacional de Inversión Extranjera).

[14] Steven Zahniser, NAFTA at 13: Implementation Nears Completion (Washington, D.C.: ERS, USDA, March 2007), p. 9.

[15] Zahniser, p. 10.

[16] INEGI, Censo Agrícola y Ganadero [Agricultural and Animal Stock Census], 1991, and ASERCA, Procampo, 2001.

[17] Sagarpa. Land sown in basic grains and oilseeds dropped from 14.2 million ha [34.3 million acres] in 2000 to 13.3 million ha [32.9 million acres] in 2005.

[18] Protection through tariff-quotas consists of determining an import quota that can enter the country free of tariffs, but any amount above the quota is subject to stiff tariffs. For corn, the initial quota stipulated for the US was 2.5 million tons and for Canada 50,000 tons. These quantities would increase by 3% each year. The initial tariff was 215% and would gradually be reduced to zero by 2008.

[19] CCC Export Credit Guarantee Program (GSM-102) and CCC Intermediate Export Credit Guarantee Program (GSM-103).

[20] See Ana de Ita, Schwentesiuss Ruta, “¿Cuánta liberalización aguanta la agricultura? Impacto del tlcan en el sector agroalimentario”, presentation to Chamber of Deputies, LXII Legislature, Comisión de Agricultura, Mexico, 2000.

[21] Of the total of corn imports in 1996, 46% went to the cattle sector, 20% to CONASUPO, 16% to the cornmeal industry, 11% to the starch industry, and 7% to wholesalers. CONASUPO imported 1,270,000 tons during the year.

[22] Of the total of corn imports in 1996, 46% went to the cattle sector, 20% to CONASUPO, 16% to the cornmeal industry, 11% to the starch industry, and 7% to wholesalers. CONASUPO imported 1,270,000 tons during the year.

[23] According to information from the Comité de Cupos de Importación de Maíz, Aserca, Sagarpa.

[24] See Ana de Ita, “Maíz transgénico en México: apagar el fuego con gasolina” [Transgenic corn in Mexico: putting out fire with petrol] in Julio Muñoz, Alimentos transgénicos, Mexico, Siglo XXI, 2003.

[25] See Ana de Ita, “El control transnacional del mercado de maíz en México y su responsabilidad en la contaminación transgénica del maíz nativo” [Transnacional control of the corn market in Mexico and its responsibility for the transgenic contamination of native corn], in RAPAL, UACH, Memoria del Foro, Mexico, August 2002

[26] Program for Direct Subsidies to Producers for Trade Surpluses for Productive Reconversion, Integration of Agrofood Chains and Attention to Critical Factors, which include among their means of support subsidies for: access to forage grains, shipping, guaranteed purchase, export, and land freight.

[27] Luis Hernández, “Cargill ‘El maíz de sus tortillas’”, La Jornada, 30 January 2007.

[28] Data from Sagarpa.