11-Oct-2014

Globe and Mail

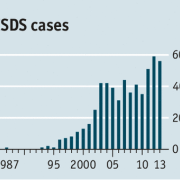

Climate change is already causing about $600-billion in damages annually, gobally. Oil and gas companies could soon find themselves on the hook for at least part of the damage.

7-Oct-2014

Global Research

The real threats to ‘freedom’, ‘democracy’, ‘decency’ and ‘fairness’ do not lie in Syria or Iraq. The destruction of national sovereignty, democracy, freedom, decency, quality of life and livelihoods is being carried out by corporate vultures under the guise of the secular theology of neoliberalism, not least in practice via free trade and investor rights agreements.

6-Oct-2014

Washington Post

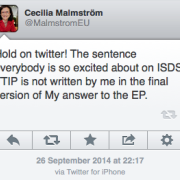

The Obama administration’s insistence on ISDS may please Wall Street, but it threatens to undermine some of the president’s landmark achievements in curbing pollution and fighting global warming.

6-Oct-2014

The Conversation

While it would be wrong to say that the TTIP will lead to the wholesale privatisation of public services, it would potentially constrain governments’ ability to reverse past policy decisions to open up public services to competition as this would become a treaty-based commitment.

2-Oct-2014

Public Citizen

The Obama administration’s precarious justifications for the investor-state dispute settlement (ISDS) regime may determine the fate of the transatlantic free trade agreement, said Public Citizen.

29-Sep-2014

Open Democracy

Europeans are in uproar at chaotic attempts by the EU presidency to rush through ’secret courts’ for investors to sue governments who try to protect their citizens and public services.

28-Sep-2014

Occupy London TV

Occupy Democracy is organising a time limited occupation from the 17th - 26th October to debate the flaws in the UK’s democracy, such as the Transatlantic Trade and Investment Partnership.

25-Sep-2014

Gobierno del Ecuador

The 11th meeting of the UNASUR Working group of highly qualified experts on investment dispute settlement took place in Quito from 23-26 September at the Ministry for External Affairs and Human Mobility.

23-Sep-2014

Eurasia Review

This study considers the likely regulatory impact of the proposed EU-US Transatlantic Trade and Investment Partnership (TTIP) in three key policy areas: investor protection, public services and food safety.

20-Sep-2014

World Trademark Review

Long-running litigation between Uruguay, which has some of the toughest anti-smoking laws in the world, and cigarette giant Philip Morris could have direct consequences for plain packaging legislation globally. Could it also pave the way for legal action in Europe?