Explainer: The different types of investor-state dispute settlement

All the versions of this article: [English] [Español] [français]

25 January 2024

Explainer: The different types of investor-state dispute settlement

by bilaterals.org

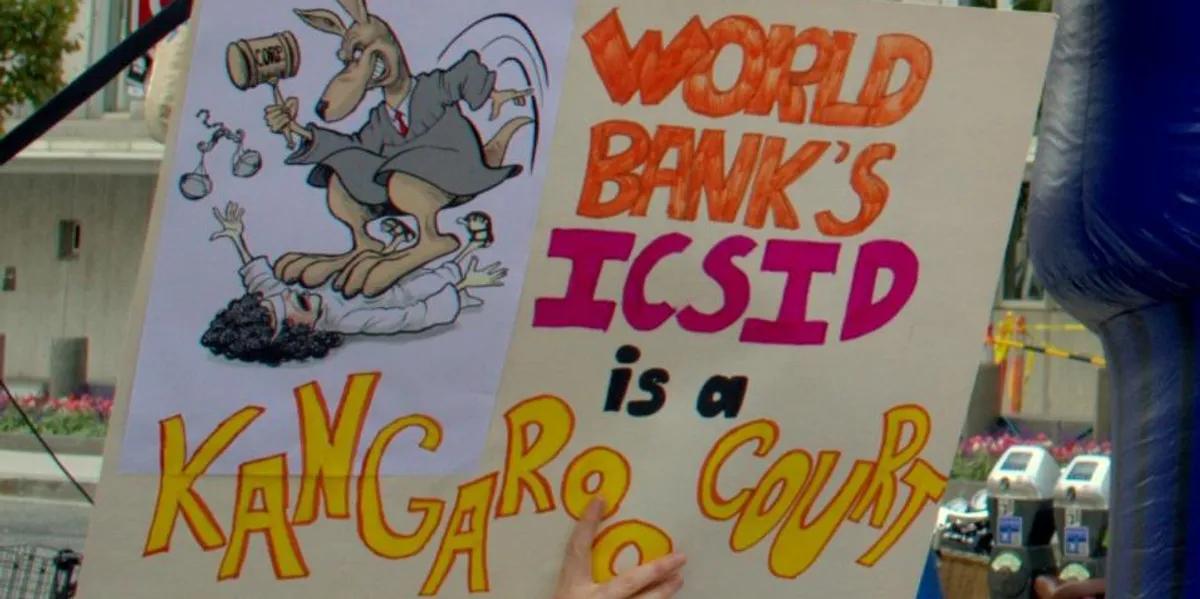

Investor-state dispute settlement (ISDS) is a mechanism for settling disputes included in many free trade agreements (FTAs) and bilateral investment treaties (BITs). It allows a foreign investor to sue a state if it claims that new laws or regulations in the public interest, even in the face of new scientific evidence, could adversely affect its expected profits or investment potential. They can then seek compensation through binding arbitration and avoid going to a public court. Corporations typically seek compensation that can amount to millions or billions of US dollars. Critics say it creates a parallel, pro-corporate legal system exclusively for transnational corporations. The power rests with for-profit arbitrators, usually from the corporate sector, who may be subject to unverifiable conflicts of interest. [1] While most ISDS cases are brought under a free trade or investment agreement, other instruments can be invoked to initiate a dispute, namely investment contracts and national investment laws. For the past 10 years, civil society groups around the world have fought against ISDS, which has helped to reject some free trade and investment agreements, notably the Energy Charter Treaty. What type of ISDS arbitration has been the most used by corporations? Why is it important to understand the different forms of ISDS?

Arbitration under trade and investment agreements

Investment treaty arbitration is a post-colonial invention of the 1960s, designed to protect the assets of former colonial powers from newly independent states. It was first mentioned in 1969 in the Indonesia-Netherlands BIT. The vast majority of ISDS cases are brought under such treaties. According to the International Centre for Settlement of Investment Disputes (ICSID), part of the World Bank Group and the most used arbitration forum, FTAs and BITs are invoked in 84% of the cases it administers. The Energy Charter Treaty and the North American Free Trade Agreement were invoked in 13% and 12% of cases respectively. [2] This is highly problematic because of its systemic and global impact. Any investment (e.g. enterprise, shares, bonds, derivatives, contracts, intellectual property rights, licences, property) made by a company from one signatory state in another signatory state can be protected by a trade and investment agreement.

Arbitration under contracts

During the colonial era, and before the creation of modern FTAs and BITs, colonial authorities used concession contracts to grant private companies or individuals exclusive rights to extract resources, such as minerals and crops, or to carry out other economic activities in the colonies and protectorates, such as building infrastructure and operating transport systems. Investments were usually protected by the laws of the investor’s host country. When the colonies became independent, these contracts paved the way for investment contracts. They contained provisions that are still commonly used today, such as stabilisation clauses, which require states to refrain from exercising their legislative or administrative prerogatives in a way that might adversely affect the investment. They also provided for investor-state arbitration to resolve disputes. Such contract-based arbitration bypassed local legal systems and demonstrated that private parties could create systems of rules within the international legal system that suited their interests. In this sense, it was a precursor to the investment treaty arbitration that would emerge a few years later. Today, corporations may choose to negotiate a contract with a state if they are not protected by an investment treaty, or to seek better investment terms. Although not as widespread as investment treaty arbitration, 10% of the claims that the ICSID handles are brought under a contract. [3] However, given the opposition that investment treaty arbitration has faced over the past decade, contract-based arbitration may become a more common tactic for foreign investors where they are not protected by a treaty. [4]

Arbitration under investment law

Worldwide, 74 countries have national investment laws that mention investor-state arbitration, and 42 of these laws are likely to provide for consent. [5] Investment laws have been invoked in 6% of the cases administered by the ICSID. A small unit of the World Bank called the Foreign Investment Advisory Service, which advises countries on private investment flows, has played a significant role in the inclusion of ISDS in domestic investment laws. A recent study [6] showed that almost half (30 out of 65) of the countries advised by the unit subsequently enacted new laws consenting to arbitration.

How are they related?

Investment arbitration rules, regardless of their legal instrument, aim to push an economic development model based on the liberalisation and promotion of foreign investment. They favour the primacy of business-friendly international investment rules over domestic and sovereign law. In addition, arbitration awards and legal fees can be very high and significant for debt-stricken countries in the Global South. This money could instead be used for social and public policies. For example, Nigeria was ordered to pay US$ 11 billion to the British Virgin Island-based energy company P&ID under a contract. [7] In a case under the Netherlands-Poland BIT, the Dutch firm Eureko received US$ 4.4 billion in compensation for Poland’s decision to maintain domestic control over the country’s public insurance company. [8] In El Salvador, Pacific Rim Mining Corp, a Canadian company that wanted to build a massive gold mine in El Salvador using water-intensive cyanide ore processing, claimed that the government had violated its domestic investment law by not issuing a permit for the mine. The ICSID ultimately rejected the company’s claim and ordered it to pay US$ 8 million of the US$ 12 million the country paid in legal fees. But the company refused to pay, and the Central American state has been chasing the money ever since. [9] ISDS raises serious democratic concerns. It is the continuation of a colonial pattern of advancing the interests of transnational capital, at the expense of the general interest. It must therefore be stopped.

Footnotes:

[2] https://icsid.worldbank.org/sites/default/files/publications/2023.ENG_The_ICSID_Caseload_Statistics_Issue.2_ENG.pdf

[3] https://icsid.worldbank.org/sites/default/files/publications/2023.ENG_The_ICSID_Caseload_Statistics_Issue.2_ENG.pdf

[5] https://www.iisd.org/itn/en/2020/06/20/why-do-states-consent-to-arbitration-in-national-investment-laws-tarald-berge-taylor-john/

[6] https://www.iisd.org/itn/en/2020/06/20/why-do-states-consent-to-arbitration-in-national-investment-laws-tarald-berge-taylor-john/

[7] The award was then overturned after a British court found that the company had paid bribes to a Nigerian official in connection with the gas contract (https://www.iisd.org/itn/en/2021/03/23/corruption-and-confidentiality-in-contract-based-isds-the-case-of-pid-v-nigeria-jonathan-bonnitcha/, https://www.reuters.com/business/energy/nigeria-wins-bid-overturn-11-billion-bill-collapsed-gas-deal-2023-10-23/)