US Israel Free Trade Agreement damage assessment

Institute for Research: Middle Eastern Policy | 20 June 2019

US Israel Free Trade Agreement damage assessment

Why has the Israel Free Trade Area Agreement (ILFTA) been so bad for America? Will Israel and its lobby advance even worse U.S.-Israel initiatives?

On this day 35 years ago following bitter complaints by U.S. exporters, the FBI launched a counter espionage investigation targeting the American Israel Public Affairs Committee (AIPAC) and the Israeli embassy. U.S. exporters at the time were near unanimously opposed to opening the vast U.S. market to Israeli exporters in exchange for limited, variable and tightly controlled U.S. access to Israel’s tiny market.

AIPAC and Israel worked every angle to pass the 1985 U.S. Israel Free Trade Area Agreement (ILFTA). ILFTA was the first of a string of so-called “Free Trade Agreements.” The joint effort by Israel and its lobby included stealing and using data provided in confidence by U.S. exporters to the International Trade Commission, which ITC had compiled into a classified report called “Probable Economic Effect of Providing Duty Free Treatment for U.S. Imports from Israel, Investigation No. 332-180.”

By purloining and using the report against U.S. industry, and leveraging a vast coordinated political campaign contribution system, the Israel lobby won passage of ILFTA in 1985. ILFTA has produced a $182.25 billion bilateral trade deficit in goods. This report examines why ILFTA is the worst performing bilateral FTA in terms of cumulative trade deficit, surpassed only by the multilateral NAFTA deal.

$182 billion cumulative U.S. trade deficit with Israel 1985-2018

Source: U.S. Census Foreign Trade Data, Cumulative Trade Surplus (or Deficit) – $ Billion, compiled and inflation adjusted by IRmep.

Background

The Office of the U.S. Trade Representative has claimed ILFTA—America’s first FTA—was the “foundation for expanding trade and investment between the U.S. and Israel.” Martin Indyk, former director of AIPAC’s affiliated think tank the Washington Institute for Near East Policy—pushed the deal and later said it was the “wedge that opened up the Congress to free trade agreements throughout the world, including the NAFTA agreement.”

However, a review of how ILFTA came into existence and how it works today reveals why it is the worst bilateral agreement ever signed by the U.S. Key to its failure is that the FTA was solely designed to benefit Israel and not the U.S. The inability of U.S. policymakers to uphold U.S. interests and law enforcement failures also contributed to the debacle.

The initiative for a bilateral trade deal came at the insistence of Israel and its U.S. lobby AIPAC. Along with favored economist Stanley Fischer, the group viewed unfettered Israeli exports to the U.S. as a means to stave off the results of severe Israeli economic mismanagement and isolation from the country’s neighbors.

U.S. industry, upon first learning about a proposed Israel free trade deal in the Federal Register in 1984, correctly saw the deal as a political give-away orchestrated by Israel that would open the way for other politically motivated and distorting trade deals.

The International Trade Commission held hearings in Washington in 1984 and encouraged U.S. industries to testify and privately submit sensitive business information, including proprietary market data and industry processes, detailing why they opposed the U.S. Israel Free Trade Area. Their data was compiled into a 300-page report the ITC classified and vowed to protect. Industry representatives were livid over the data theft and demanded a criminal investigation. The FBI launched an espionage and theft of government property investigation in June of 1984. The investigation uncovered three AIPAC officials reproducing and circulating the stolen report, and traced the theft back to Israeli Minister of Economics Dan Halpern.

Seeing momentum building against the deal, Halpern who worked out of the Israeli embassy in Washington, obtained a stolen copy of the classified ITC report and passed it on to both Israel and AIPAC. AIPAC used the proprietary information to counter key industry concerns in its public relations, trade and lobbying strategy, turbocharged by AIPAC’s vast coordinated campaign contribution network. At the time AIPAC secretly directed campaign contributions from an armada of “stealth PACs” to AIPAC-favored politicians. This is the name of pro-Israel political action committees with benign and misleading names with a mission to advance Israel. The lopsided deal passed in 1985. The FBI investigation ended in early 1987 after the FBI predicted that Halpern would simply claim diplomatic immunity. The AIPAC officials continued their careers with no adverse consequences.

How ILFTA works to Israel’s benefit

AIPAC and Israeli policy analysts who reviewed the stolen ITC document in 1984 would have quickly realized the huge threat U.S. agricultural products presented to Israel’s highly protected market. In subsequent decades both worked tirelessly to stymie any inroads by U.S. processed and unprocessed food exporters. As agricultural and other key U.S. industry groups predicted, their products remained mostly locked out of the Israeli market with few meaningful USTR efforts to improve market accessibility. It is the ongoing market access lockouts of key U.S. export categories that have now delivered a $182.25 billion cumulative deficit to the U.S. since ILFTA passage.

Beyond merchandise trade, Israel’s unfair advantage is replicated in the trade of services. According to the USTR, in 2017 Israel exported $7.4 billion in services to the U.S. in the form of R&D, travel and transportation services. The U.S., which is a global leader in service exports, only exported $5.9 billion in services to Israel, mostly travel, transport and technical service related.

Defenders of the trade deal claim it has expanded bilateral trade by boosting U.S. exports to Israel and the overall volume of trade. However, upon close examination, a large share of U.S. exports to Israel are an illusion caused by the unique nature of U.S.-Israel exchanges.

The largest category of U.S. goods transfers to Israel —military hardware—is not counted by the U.S. Census Bureau as exports. The weapons included in such transfers are guaranteed under the current 10-year $38 billion Memorandum of Understanding (MOU) and are entirely paid for by U.S. taxpayers, not Israel.

This wasn’t always the case. Before Israel and its lobby convinced the U.S. to open itself to unrestricted Israeli exports, intense lobbying largely did away with U.S. weapons sales in exchange for U.S. taxpayer funded weapons transfers to Israel. Through the end of the 1960s, U.S. threats to withhold sales of critical weapons systems, such as nuclear delivery capable fighter jets, provided at least the appearance—though seldom the reality—of U.S. influence over Israel. From the 1970s onward, Congress and the White House—under pressure by Israel and its lobby—began to rubber stamp a series of huge foreign aid packages subsidizing massive weapons transfers to Israel premised on the argument that Israel was a Cold War ally. Long after the fall of the Soviet Union, Israel continues to receive mountains of military support free of charge from the U.S. under ever more dubious and shifting pretexts. Other countries must pay to import U.S. weapons.

$260.9 billion cumulative U.S. foreign assistance to Israel 1949-2019

Source: U.S. Foreign Aid to Israel, Jeremy M. Sharp, Congressional Research Service, April 10, 2018 (Acknowledged, cumulative, inflation adjusted.)

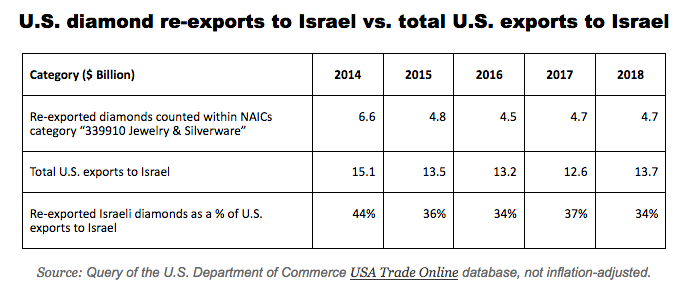

But what about the $13.7 billion in U.S. exports to Israel reported in U.S. Census Bureau International Trade data for the year 2018? To understand why this is not an indicator of a healthy trading relationship requires first examining the unique profile of U.S. imports from Israel.

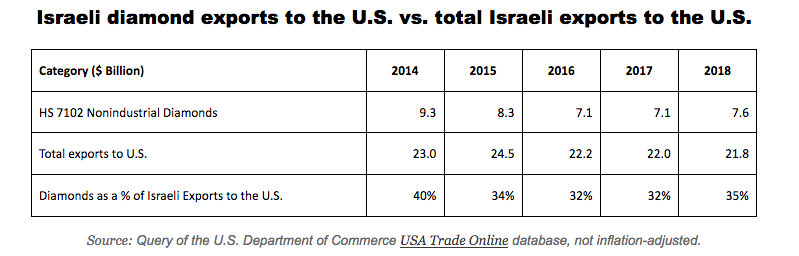

Non-industrial diamonds, which Israel sources from Africa as raw diamonds, to then cut, polish and sell in jewelry stores across America, represented 35% of Israel’s total $21.8 billion in goods exports to the U.S. in 2018. Over the past five years diamonds have averaged 35% of total exports and have long been Israel’s number one U.S. export category.

However, diamond exports from the U.S. to Israel are also a major export category. In 2018 diamonds represented 34% of $13.7 billion in U.S. exports to Israel. How can this be? The U.S. has only one active diamond mine and its production almost never leaves the U.S. So why do trade statistics report U.S. diamond exports to Israel averaging $5 billion per year?

Israeli diamonds flow into the U.S. tariff-free as merchandise intended to meet consumer market demand. Sometimes that demand never materializes, and the diamonds are shipped back to Israel to be inventoried, re-mounted, or recut and exported again to the U.S. and other markets. The trans-Atlantic return of these diamonds produces nothing of value in terms of net sales for the U.S. or Israel. But moving the diamonds back to Israel does produce something else of value to Israel—the appearance of U.S. access to the Israeli market and the illusion of a meaningful flow of “U.S. exports” to Israel. The U.S. Trade Representative frequently trumpets such exports as a victory, claiming “since 1985, when the United-States Israel FTA came into force, U.S. exports to Israel have risen by 456 percent.”

Unfortunately for U.S. exporters, this claim of vast, economy-boosting U.S. exports to Israel is just an accounting game. While Israel’s diamond exports to the U.S. are very real and always stand to produce a net benefit to Israel, a large percentage of what is counted and reported as U.S. goods exports to Israel is simply an accounting trick.

The Trump administration and trade with Israel

The Trump administration has been more beholden to Israel and its lobby’s policy demands than any presidency in recent history. The administration has defied established international consensus by recognizing Jerusalem as Israel’s capital, turning a blind eye to endemic Israeli human rights violations, overturning aid to Palestinian refugees and recognizing Israeli sovereignty over Syria’s Golan Heights. Despite reflexively adopting the Israeli position in almost any given policy debate, even the Trump administration appears to have had serious misgivings about ILFTA.

This disagreement is rooted in the administration’s overall beliefs about the true cause of trade deficits. President Trump clarified his administration’s trade policy on September 25, 2018 at the UN General Assembly claiming the $800 billion annual U.S. trade deficit was a result of non-reciprocal market access and “broken and bad trade deals.” Trump then vowed to “systematically renegotiate” these bad trade deals. This renegotiation initially included Israel.

According to a 2018 report from the U.S. Department of Agriculture’s Foreign Agricultural Service, under the 1985 Israel deal, “virtually any product produced in Israel that can be competitive in the U.S. market can enter the U.S. duty-free…In contrast, U.S. products continue to face high tariffs in many sectors limiting their access to the Israeli market.”

Despite Trump administration moves to boost U.S. agricultural exports to Israel, exporters should expect little in the way of meaningful change driven by the administration. With Benjamin Netanyahu seeking to regain his position as prime minister in September following a failed earlier bid during parliamentary elections, the Trump administration is unlikely to engage in even symbolic pressure over trade issues. Israel has successfully resisted such U.S. pressure before. From 2005-2008 Israel appeared on a U.S. Trade Representative watchlist for pharmaceutical industry intellectual property violations over copycat drug exports to the U.S. The Bush administration did little else about it.

In the broadest sense, the U.S. has entered into a trade pact under which it fully opens its vast market to a partner that is committed to a mercantilist strategy of export promotion and closed domestic markets. U.S. exporters daring to consider Israel’s miniscule market see this firsthand when they apply to the Israeli government for permission to export via an online form. They must first swear their products are not already present in Israel, before patiently waiting out an opaque decision from Israel about whether they will be allowed to trade.

Will ILFTA be overshadowed by even more harmful Israeli initiatives?

The U.S. bilateral trade deficit with Israel is the largest of any bilateral FTA. This is the result of the particular circumstances that led to its creation and maintenance. ILFTA exists not to benefit the U.S. economy but rather Israel’s due to the intense, oftentimes highly secretive, and sometimes outright illegal actions of Israel and its lobby in the United States. The Israel FTA is not important because of the overall impact it has on trade, which is relatively insignificant. Rather, the US Israel FTA’s results are an indicator of the harmful overall role Israel and its lobby have on U.S. policymaking.

2018 and cumulative U.S. trade surplus (or deficit) under all FTAs ($ billion)

Source: U.S. Census Foreign Trade Data, Cumulative Trade Surplus (or Deficit) – $ billion, compiled and inflation adjusted by IRmep.

The Kennedy administration and Senate Foreign Relations Committee understood the threat in the early 1960s. Their regulatory efforts culminated in the November 21, 1962 Department of Justice order that the American Zionist Committee umbrella, of which AIPAC was an integral member, begin to register as the foreign agent of Israel.

The effort faltered and then failed in the years following JFK’s assassination. Ever since, the U.S. has been forced to assume an ever greater role as Israel’s sole relevant benefactor for diplomatic, military, moral and economic support. Unfortunately for most Americans, ongoing fallout from the FTA may not be the most damaging initiative launched by Israel and its lobby. Considering the little known past as prologue, what other “bad deals” beyond trade are looming? IRmep forecasts the following probabilities, most of which could vastly exceed the harmful fallout of the FTA.

1. 100% probability the U.S. trade deficit with Israel will continue to grow. Under immense ongoing pressure from Israel, Israel lobby campaign contributors. and lobbying the U.S. will be unable to pursue the interests of U.S. exporters and the bilateral trade deficit with Israel will continue ballooning to new heights. If the deal is renegotiated, it will be done in a way that again prioritizes Israeli interests over those of the U.S.

2. 100% probability Congress will greatly exceed MOU caps on U.S. military transfers to Israel. Congress has been chafing under military aid restrictions in the Memorandum of Understanding with Israel and will freely exceed aid ceilings and ignore requirements that Israel return U.S. military aid in excess of caps.

3. 70% probability that larger numbers of Israeli companies entwine with U.S. companies via state partnerships. Israel will continue its drive to economically entwine Israeli corporations with U.S. corporations via under-the-radar initiatives within state governments via secretive vehicles such as the Virginia Israel Advisory Board.

4. 50% probability the U.S. attacks Iran in fulfillment of a long-term Israeli demand. Israel lobby pressure for the U.S. to attack Iran is immense and long preceded and overshadowed similar Arab Gulf state demands. Such an unnecessary U.S. war with Iran, using the costs of the unnecessary war with Iraq as a benchmark, could cost the U.S. tens of thousands of casualties, millions of combatant and noncombatant casualties in the region, and cost far in excess of $4 trillion while possibly touching off a global economic depression.

Sources used in this report that were first made public by IRmep

International Trade Commission report “Probable Economic Effect of Providing Duty-Free Treatment for Imports from Israel” unlawfully obtained by AIPAC and the Israeli government in 1984. Obtained by IRmep over ITC objections via a direct appeal to the Interagency Security Classification Appeals Panel in 2011. https://www.israellobby.org/ustr/

FBI counter-espionage and theft of government property investigation targeting the American Israel Public Affairs Committee (AIPAC) and the Israeli embassy. Obtained by IRmep via the Freedom of Information Act after FBI declassification in 2009. https://www.israellobby.org/economy/

Documents submitted by U.S. industry and labor groups in opposition to ILFTA obtained by IRmep from the International Trade Commission via the Freedom of Information Act in 2008. https://www.israellobby.org/FTA/

2019-2028 U.S. Memorandum of Understanding (MOU) to provide Israel with $38 billion in military aid over a ten year period. First obtained by IRmep from the U.S. Department of State under the Freedom of Information Act in 2016 https://www.israellobby.org/MOU/

1962-1967 U.S. Department of Justice files on the effort to register AZC/AIPAC as an Israeli foreign agent. Obtained by IRmep under the Freedom of Information Act in 2008. https://www.israellobby.org/azcdoj/

Senate Committee on Foreign Relations investigation into the Activities of Nondiplomatic Representatives of Foreign Principals in the United States report working papers obtained by IRmep in 2010.

Virginia Office of the Governor documents about the Virginia Israel Advisory Board obtained through the Virginia Freedom of Information Act in 2018.