23-Apr-2021

Inequality.org

Pakistan is the latest to start withdrawing from international treaties that give corporations the power to sue governments over environmental and public interest regulations.

20-Apr-2021

International Arbitration

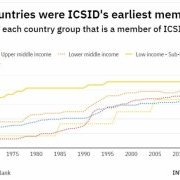

One of the most significant early proposals for a multilateral agreement to protect private foreign investment was launched in 1957 by groups of European business people, and lawyers.

14-Apr-2021

Stock Market Wire

Mining group Pathfinder Minerals said a dispute over the ownership of a mining title in Mozambique could see it incur estimated losses of more than $621.3 million.

12-Apr-2021

Business Standard

Cairn Energy has offered to invest the entire award money in India, which includes the principal amount of $1.2 billion and interest of $500 million if the government agrees to enforce the award.

8-Apr-2021

Investment Monitor

From colonisation to investor-state dispute settlements, rich countries have sought to exploit and influence their poorer counterparts for centuries, but how did globalisation in its current form come to be?

6-Apr-2021

Investment Monitor

Investment treaties largely replaced colonial gunboats as a way to continue to exploit the resources of foreign countries.

1-Apr-2021

Global Justice Now

Corporate courts are an unjust mechanism that can block climate action. The UK should reject them.