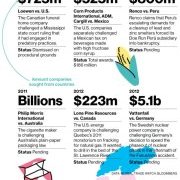

investor-state disputes | ISDS

Investor-state dispute settlement (ISDS) refers to a way of handling conflicts under international investment agreements whereby companies from one party are allowed to sue the government of another party. This means they can file a complaint and seek compensation for damages. Many BITs and investment chapters of FTAs allow for this if the investor’s expectation of a profit has been negatively affected by some action that the host government took, such as changing a policy. The dispute is normally handled not in a public court but through a private abritration panel. The usual venues where these proceedings take place are the International Centre for Settlement of Investment Disputes (World Bank), the International Chamber of Commerce, the United Nations Commission on International Trade Law or the International Court of Justice.

ISDS is a hot topic right now because it is being challenged very strongly by concerned citizens in the context of the EU-US TTIP negotiations, the TransPacific Partnership talks and the CETA deal between Canada and the EU.

24-Apr-2014

Gene Ethics

Australian PM Abbott’s trade deals with Korea, Japan and 12 other Pacific rim countries may give foreign companies the right to sue our governments for claimed losses over GM-free zones. A Greens Bill now in the Senate seeks to stop corporate predators having this right in all future treaties.

22-Apr-2014

Al Jazeera

Last week more than 300 international and national civil society organizations wrote to the president of the World Bank, Jim Yong Kim, during its biannual meeting in Washington, denouncing the bank’s involvement in the case of Pac Rim Cayman LLC v. El Salvador.

19-Apr-2014

TNI

Frank exchange of views between the EU Commission and civil society representatives on the introduction of special rights for companies in the TTIP, through the mechanism of investor-state dispute settlement (ISDS).

17-Apr-2014

CEO

See through the sweet-talk with Corporate Europe Observatory’s guide to investor-state dispute settlement (ISDS).

17-Apr-2014

CEO

This film presents some of the dangers of the investor rights within the proposed EU-US trade deal.

14-Apr-2014

The Guardian

A multinational mining company has been accused of launching "a direct assault on democratic governance" by suing El Salvador for more than US$300m (£179m) in compensation, after the tiny Central American country refused to allow it to dig for gold amid growing opposition to the exploitation of its mineral wealth.

12-Apr-2014

The Greens and independent senator Nick Xenophon have said the government will face a tough battle if it seeks to ease foreign investment restrictions.

8-Apr-2014

So straightforward was Australia’s first trade deal with Japan that the Japanese thought it was a trick.

7-Apr-2014

Concilium

The Permanent Representatives Committee (Coreper) today approved, on behalf of the Council, an agreement reached with the European Parliament on a framework for managing financial responsibility linked to investor-state dispute settlement proceedings.

6-Apr-2014

Japanese companies would be able to sue Australian governments under clauses expected to be included in the Australia-Japan free trade agreement.

3-Apr-2014

IP Watch

April Fool’s? European trade commissioner Karel de Gucht says, during a 1 April hearing in Brussels of the International Trade Committee of the European Parliament, that he would agree to drop ISDS from the TTIP if the United States would agree.

25-Mar-2014

Policy Mic

The translantic trade agreement would undermine hard-fought regulations and open up a large part of the world to greater exploitation without regulation. Fracking would go global.

20-Mar-2014

Bloomberg

A high-profile campaign by opponents to ISDS could complicate TTIP talks long after the listening period in Europe ends.

15-Mar-2014

FT via KEI

Germany has introduced a stumbling block to landmark EU-US trade negotiations by insisting that any pact must exclude a contentious dispute settlement provision (ISDS).

14-Mar-2014

Lexology

This is the first instance in which the US Supreme Court has interpreted a bilateral investment treaty (BIT).

13-Mar-2014

Latin American Herald Tribune

In a 2-1 decision, the World Bank’s arbitration panel has rejected Venezuela’s request for "reconsideration" of its September 2013 finding that it had jurisdiction and that Venezuela was liable for the expropriation of ConocoPhillips’ investments in the Latin American nation.

10-Mar-2014

TNI

Corporations, backed by lawyers, use international investment agreements to scavenge for profits by suing Europe’s crisis countries.

6-Mar-2014

For a variety of reasons, including poor management of public perceptions, the administration’s trade agenda is in trouble. Much of the public’s antipathy toward trade agreements can be boiled down to concerns about the so-called Investor-State Dispute Settlement (ISDS) provision. ISDS enables foreign investors to circumvent domestic legal processes and sue host governments in third-party arbitration tribunals for unfair or discriminatory treatment – described hyperbolically by those fanning the flames of opposition as “running roughshod over domestic laws, regulations, and sovereignty.”

6-Mar-2014

BBC

A judge in the US has ruled that lawyers representing Amazonian villagers used bribes to secure compensation worth billions of dollars from oil company Chevron in Ecuador.

4-Mar-2014

Pakistan has sought a 20-day extension to file its reply to the International Centre for Settlement of Investment Disputes (ICSID) against a damage claim of $2.1 billion filed by Turkish firm M/s Karkey Karadeniz Elektrik Uretim. The sources said Pakistan had to submit its reply to the international body by February 28, 2014 but it was delayed due to a change in legal firm.