9-Sep-2020

New York Times

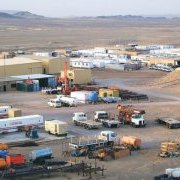

Pakistan is seeking the reversal of a $5.8 billion penalty imposed by an international tribunal for denying a mining lease to an Australian company, saying that paying the fine would hinder its handling of the coronavirus pandemic.

8-Sep-2020

Climate Change News

The Japanese government is blocking reform of a treaty that allows energy companies to sue nation states when climate policies affect their profits.

4-Sep-2020

International Law Office

With state measures in response to COVID-19 being compounded by an already difficult economic environment for investors, they may have little choice but to challenge those measures.

2-Sep-2020

The Economic Times

Seclink Technologies, funded by the royal families of the United Arab Emirates and Bahrain, plans to seek arbitration over the issue under the Bilateral Investment Promotion Protection Agreement.

2-Sep-2020

The Zimbabwe Mail

There are only two types of farmers that can be compensated for both land and improvements on farms. On of them is farmers whose land was protected by Bilateral Investment Protection and Promotion Agreements.

31-Aug-2020

Total Montenegro News

Knežević and the Atlas Group’s affected companies have the right to initiate arbitration proceedings against Montenegro, according to the arbitration rules of UNCITRAL, ICC or ICSID.

28-Aug-2020

Corrs Chambers Westgarth

In response to the COVID-19 pandemic, governments globally are engaging in a difficult balancing act of protecting public health, mitigating economic damage and avoiding interference with private rights.

27-Aug-2020

Global Legal Chronicle

The US subsidiaries of Bridgestone Corporation lost a $20 million plus arbitration claim against the Republic of Panama filed by under the US-Panama Trade Promotion Agreement.