15-Feb-2019

Global Justice Now

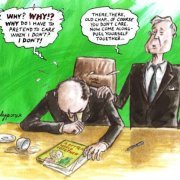

A Q&A to deal with tricky questions about corporate courts and our campaign against them.

11-Feb-2019

The East African

A group of US investors have taken Rwanda to an international court, seeking compensation of $95 million after the government seized their mining concessions, effectively denying them operating licences.

8-Feb-2019

Express Tribune

Pakistan said to have gathered fresh ‘evidence of corruption’ in the procurement of a rental power project (RPP) contract by the Turkish company.

5-Feb-2019

Globe Newswire

Hungarian State has been ordered to pay Sodexo an award of about 73 million euro, before interest.

24-Jan-2019

Open Democracy

Campaigners dressed as wolves in suits invaded the streets of Davos to highlight the real face of private-sector influence.

22-Jan-2019

Belarus Digest

In late 2017 and 2018, Belarus faced a record-breaking three investment arbitration claims.

7-Jan-2019

Morocco World News

A metallurgical industry project is the center of the dispute.

3-Jan-2019

Washington Post

Investment treaties with ISDS provisions make it hard to tax foreign firms and worsen human rights and labor practices.

3-Jan-2019

Ministry of External Affairs, Goverrnment of India

As released by the Goverrnment of India