India’s experience with investment treaty disputes and related damages

Madhyam | 17 August 2023

India’s experience with investment treaty disputes and related damages

By Tathagata Choudhury | Briefing Paper # 62

India is an attractive destination for foreign investment (among the top 10 investment-importing countries) and is increasingly growing as an outward investor (among the top 20 investment-exporting countries).[1] Since its economy opened up, India has been a willing participant in the international investment treaty regime. It signed its first bilateral investment treaty in 1994[2] and has been relatively active in signing bilateral investment treaties (BIT).

Like most older generation BITs, these treaties were negotiated to promote foreign investment and, in line with the existing BIT models, had mechanisms for investment protection and dispute resolution, including investor-state arbitration. These mechanisms allowed foreign investors to seek recourse to international arbitration where disputes arose. While India has largely benefited from foreign investments, it has also faced challenges in navigating the complexities inherent in the investment treaty regime manifested through the investor-state dispute settlement (ISDS) system.

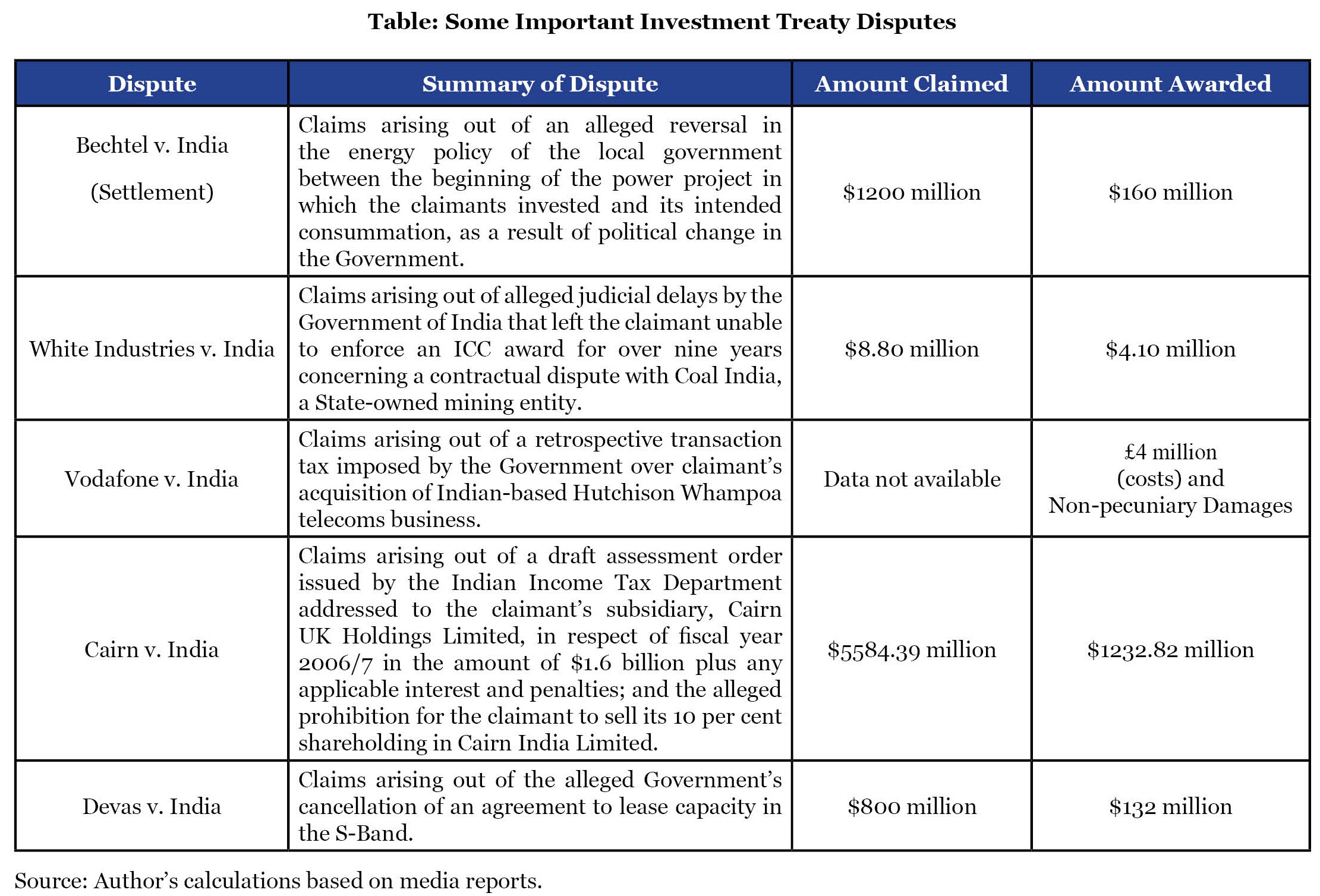

India has been sued 26 times, surpassed by only 11 other countries.[3] Of these, India has lost five times while winning two times, with the rest of the disputes settled, discontinued, or pending.[4] These negative experiences, which have been a major headache for most host states, especially in the developing world, have inflicted financial burdens, including threats to sovereign assets abroad, but also provide India with an opportunity to relook its policies as an emerging economy that wants to be counted as a leader of the developing world.

To this effect, this briefing paper will try to analyse some major investor-state disputes (ISDs) in which India has received an adverse award with significant financial compensation awarded to investors. Part I of this paper explains the dangers which host states face from ISDs awards. These manifest in the form of crippling awards for compensation or damages[5] which have consequences beyond financial outlays. Part II of the paper will deal with India’s experience with investment arbitration and will analyse the leading cases where India has received awards for damages against it based on publicly available sources or where such awards have been published. Part III of the paper delves into learning from these disputes. Part IV briefly discusses the steps India has taken to respond to these ISDs.

I. Damages: An International Obligation for Breach of Investment Treaties

Under international law, a state must provide reparations to remedy breaches of its international obligations. In the case of claims arising from a breach of a BIT obligation, the claimant by the design of the treaty is a foreign investor bringing the ISD against a sovereign state. Here, reparation is mostly expressed in monetary terms in the form of damage or compensation. Reparations can also be available in the form of restitution[6], but this is generally limited in grant under ISDs, considering it is either impractical or disproportionate considering sovereignty considerations. Any damages paid to the grieved investor must in principle “wipe out” the consequences of the host states breach of the BIT linked obligations and place the investor in a position that it would be had that breach not been committed.

The risks from compensation awarded to investors are multifaceted. For example, in the Tethyan Copper v. Pakistan, the award against Pakistan was to the tune of USD ($) 4 billion award (excluding interest) which was as large as the International Monetary Fund’s bailout to Pakistan two months ago.[7] Therefore, this raises systemic risk.

At the same time, there is a risk that high amounts of damage will cause regulatory freeze on host state policies. This means that due to the high value damages imposed, host states are dissuaded from undertaking any regulator changes in fear of any reforms being challenged by investors, notwithstanding whether the reforms were being undertaken in the public interest. Therefore, it acts to interfere directly with the sovereign rights of host states and their obligation to regulate in the public interest.

II. India’s Experience with Investment Arbitration

The first investment arbitration initiated against India arose from the Dabhol Power Plant project. However, most of the ISDs initiated concerning the project were settled between parties, with awards not being publicly available. The disputes arose out of inter alia reversals in the local government’s energy policy, and there were political compulsions to cancel the project in light of public perceptions of the project being too expensive.[8]

Except for Bechtel v. India[9], however, all the other ISDs initiated were settled, with non-pecuniary relief being awarded. Only in Bechtel v. India, the investor was awarded a compensation of $160 million against a claimed compensation of $1200 million.[10]

(a) White Industries Dispute

The backlash against investment arbitration in India, however, started with the White Industries Case[11], where India received an award for damages to the tune of $4.1 million against it. Significantly, the dispute opened the floodgates for investment treaty arbitrations initiated against India.

The arbitration claim arose from judicial delays in enforcing an international commercial arbitration award issued under the International Chamber of Commerce (ICC) rules (Commercial Award) against an Indian state-owned enterprise (SoE). The claimant was unable to enforce the award for 9 (nine) years, leading to the initiation of investment treaty arbitration under the India–Australia BIT.

A significant aspect of this dispute was the tribunal’s decision that a delay in enforcing the Commercial Award violated India’s obligations to provide an “effective means” of asserting claims and enforcing rights. This obligation was not found in the India–Australia BIT (Australia BIT) but invoked using the most favoured nation treatment (MFN) clause of the Australia BIT to apply the threshold applicable under the India-Kuwait BIT.[12] The tribunal overruled India’s objection to applying a non-treaty threshold ruling that borrowing a beneficial substantive provision from a third-party treaty does not subvert the negotiated balance of the BIT.[13] In light of this background, the tribunal awarded the claimants a compensation to the tune of $4.10 million.[14]

(b) Vodafone Tax Dispute

The Vodafone Tax Dispute was the first in a series of investment treaty-related disputes which arose following an amendment to Section 9(1)(i) of India’s Income Tax Act, 1961 (ITA). The amendment with retrospective effect tried to cover within the taxation ambit indirect transfers by non-residents (Retrospective Tax). This led to a tax demand of INR 110000 million on Vodafone’s acquisition of Hutchison Essar in 2007. Notably, the amendment reversed a previous Supreme Court ruling that Vodafone was not liable for capital gains tax under Indian law with respect to acquisition.[15] Vodafone, as a result, initiated an arbitration before the Permanent Court of Arbitration (PCI) invoking the India-Netherlands BIT.

The claimants argued that the retrospective amendment, despite a previous Supreme Court judgement, amounted to a violation of fair and equitable treatment (FET) guaranteed under Article 4.1 of the India-Netherlands BIT which included an obligation of a stable and predictable regulatory environment. While the reasoned analysis of the tribunals is not known, considering that the award has not been made public as per the partially published award, India has been directed to pay INR 400 million for legal costs and refund tax which has been collected. The tribunal also held that any further attempt by India to enforce demand would violate international law.[16]

The case highlighted the dangers of the retrospective application of taxation laws and their incompatibility with the investment treaty regime. It also added to the existing debate under international law that tax law and policy are sovereign domains.

(c) Cairn Energy Tax Dispute

The next prominent dispute which arose out of India’s retrospective tax amendment was the Cairn Energy dispute.[17] The dispute arose from the retrospective taxation of an offshore transaction wherein a UK-incorporated company (Cairn UK) transferred its entire shareholding in its Jersey-incorporated subsidiary to its Indian subsidiary. Indian tax authorities thought that for this transfer, Cairn UK was liable to pay capital gains tax in India. This led to arbitration proceedings being initiated under the India-UK BIT 1994.[18]

The tribunal ruled that India had failed to uphold its FET obligations by imposing a retrospective tax and adopting measures to enforce liabilities. While carrying out a balancing exercise between India’s public policy objectives and Cairn’s interests, the tribunal thought that India did not provide a specific public purpose reason to justify the retroactive application of tax measures. On the other hand, through such a retrospective application, India deprived Cairns of the ability to consider the legal consequences of conduct which violated the core element of the FET obligation, which is legal certainty.

Having found India to be in breach of its FET obligations, the tribunal ordered India to pay damages to the tune of $1.2 billion in damages, along with legal costs incurred.[19] While Cairns had threatened to go against a huge kitty of Indian assets abroad, including Indian SoEs, in a later settlement, it dropped all such lawsuits and will now be entitled to about INR 79000 million refund of taxes that were collected from it to enforce a retrospective tax demand.[20]

(d) Devas Multimedia Dispute

The Devas Multimedia cases[21] arose out of India’s decision to cancel a satellite spectrum agreement (Agreement) between Devas Multimedia and Antrix, the commercial arm of the Indian Space Research Organisation. Investors in Devas, CC/Devas and Germany’s Deutsche Telekom (DT) challenged the cancellation of the Agreement in two ISDs under the India-Mauritius BIT and India-Germany BIT, respectively.

While allegations of corruption were levied against the deal leading to the Agreement, India argued before the CC/Devas tribunal that the Agreement was cancelled because India needed the S-band satellite spectrum for national security purposes. While the tribunal gave deference to India’s arguments that reservation of spectrum for the needs of defence and paramilitary forces could be classified as “essential security interests”, any reservation for public utility purposes could not be similarly classified.[22] Hence, it ruled that the cancellation of the Agreement and reservation of spectrum for non-security purposes breached India’s FET obligation[23] and protection against expropriation which was owed to the investor under the India-Mauritius BIT.[24] The tribunal, therefore, ordered India to pay $160 million plus accrued interest as damages to CC/Devas.[25]

India also pursued the national security-related argument before the DT tribunal but the tribunal rejected it again. The tribunal highlighted that under Article 12 of the India-Germany BIT, a measure to qualify as an “essential security interest”, must be “necessary”. To be necessary, the tribunal pointed out that there must have been a strict nexus between the regulatory measure (terminating the contract) and the objective (reacquiring the S-band spectrum for national security purposes). India’s measure was not “necessary” because India referred to various needs for reacquiring the S-band spectrum without stating an actual purpose.[26] Therefore, the tribunal found India in a breach of its FET obligations.[27] Accordingly, it passed an award for damages against India worth $132 million.[28]

III. What Went Wrong? What are the Learnings?

While a part of India’s unfavourable encounter with investment arbitration arises from the inherent structural challenges of the ISDs regime, there are other pointers relating to Indian policy, structures, and strategies. These relate to flaws, either at the level of framing of domestic policies, treaty negotiation and drafting, or a strategy during arbitration. These elements are summarized below.

(A) Treaty Negotiations and Drafting

(i) Taxation

While it is not disputed whether matters of taxation are within the sovereign domain, a distinction must be made between tax disputes and tax-related investment disputes. The former deals with disputes on whether a transaction can be taxed under municipal laws and the amount of such a tax. Under tax-related investment disputes, the legality of tax measures is not being questioned. Rather, such disputes concern allegations of a breach of a BIT due to specific sovereign measures relating to taxation.[29]

This was also noted by the tribunal in the Cairn v. India where it noted that unlike customary international law which has few restrictions on the right of a state to maintain and enforce tax laws, tax-related disputes are within the scope of investment treaties. One limitation of the older investment treaties under which tax-related disputes were brought against India was that they were drafted broadly and did not exclude any tax-related measures from their coverage.

It must also be noted that bilateral and multilateral treaties indeed limit member states’ sovereignty, but here, all member countries together decide on a common framework. However, when it comes to BIT, this limitation pits the state against third-party investors and, therefore, requires the host state to be very careful when it comes to treaty drafting, especially when such treaties are to be adjudicated by ad hoc tribunals.

(ii) Substantive Clauses

A pertinent learning from India’s arbitration experience is that some of its substantive clauses such as MFN were defined vaguely and broadly without adequate exceptions. In an ad hoc arbitration system, this allows the tribunal to provide an expansive interpretation of clauses.

For example, in the White Industries Case, the tribunal differentiated between procedural and substantive obligations and only recognised the latter obligation, allowing it a broad ambit to the MFN clause, much beyond the intention of the negotiating parties. This has been considered akin to multilateralising a bilateral treaty.[30]

The risks of tribunals exercising broad discretion in White Industries, where the tribunal found a violation of the ‘effective means’ standards from the Kuwait-India BIT, even when the relevant BIT does not contain such a provision. Applying standards from other treaties concerning different country contexts risks treaty shopping.

(B) Legal Framework and Capacity

While tribunals must consider the economic capacities of member states, states must be careful that no leeway is given by ad hoc tribunals who are mostly selected from capital-importing countries and seldom show sympathy towards specific requirements of member countries. In the game with big game players, India must impose its heft, which requires both structural and infrastructure changes.

India’s evolving regulatory environment, coupled with bureaucratic hurdles, including overzealous officials, often contributes to uncertainty for investors. Better and more sophisticated approach from regulators including an awareness of India’s international obligations is needed. Further, there should be better coordination with various stakeholders before any action is taken, so that there is less reaction after the cat flees the bag. For example, there should be a mechanism in which the legal opinion of senior legal officers and/or opinions of eminent law firms could be taken when there is a possibility that actions by sovereign agencies could incur international liability.

Additionally, India must implement a transparent, clear, and predictable regulatory framework to avoid not only legal liabilities but also to protect its reputation with investors, and attract foreign investments.

Similarly, inordinate delays in Indian courts in disposing of matters related to foreign investors can, potentially, violate India’s BIT obligations. This can be in the form of a violation of a ‘denial of justice,’ claim or a violation of the ‘effective means’ standard, requiring a lower threshold.

(c) Dispute Strategy

India also needs to be careful when it comes to strategy towards dealing with disputes. For example, in the Antrix-Devas Case, India chose to refrain from the appointment of an arbitrator of choice. This was despite the tribunal repeatedly asking India to do so. Instead, it chooses to challenge the jurisdiction of the ICC Tribunal.

Another surprising aspect of this dispute was that India did not raise the issue of corruption during the hearing even after the CBI[31] and Enforcement Directorate took action and the Comptroller and Auditor General (CAG) flagged anomalies in the Agreement.[32] In fact, the Swiss Federal Supreme expressed its surprise that India did not mention the anomalies in the Agreement when India challenged the DT award.[33] The issue of corruption could have been a mitigating factor in determining the final amount of damages India was ordered to pay. There are instances of a tribunal declining jurisdiction holding that a state consents to arbitration only for lawful investments.[34] Furthermore, even in pro-arbitration jurisdictions, awards have been set aside where the underlying contract was tainted by corruption.[35] A recent decision from the Indian Supreme Court[36] ruling that Devas being fraudulently incorporated will help India defend enforcement proceedings against its assets in various jurisdictions. It will also be useful for India in a fresh ISD launched by Devas[37], claiming that an order asking Devas to wind up is India’s attempt to not honour as ICC arbitration award against Antrix.

IV. Indian Response and the Way Ahead

The effect of India’s negative experience has resulted in a domestic backlash against international investment arbitration. As a result, India adopted two principal policy changes.

As part of the first change, India opted to terminate several of its investment treaties, or allowed them to lapse. Since 2016, India has terminated 76 such BITs. It must be noted that treaty termination does not shield India from the effects of the “sunset clauses” which means that India is liable to ISDS claims for the period of the sunset clauses under respective BITs.

The second change undertaken by India is renegotiating its bilateral investment treaties (BITs) with different nations, in line with its Model BIT. The Parliamentary Report (2021) explains that the Model BIT aims to create a balance between India’s right to regulate and investment protection which would improve India’s position as a respondent in future investment arbitrations. A notable example of this is the FET obligation. Under the revised model BIT, the FET standard has been omitted and replaced with guarantees of procedural fairness, highlighting India’s stance that substantive tax policy cannot be examined by the tribunal from a ‘due process’ perspective.

It would take to see what effect these changes would have on the Indian investment story. A recent study suggests that inward investment in India has been reduced by more than 30% in response to its treaty termination strategy.[38] However, there are examples of countries like Brazil which have seen sustainable inward investments despite signing the BIT relatively recently, while China still manages to attract high volumes of investment despite Chinese BITs not having ISD-related clauses.

A more immediate threat besides the sunset clause already mentioned is the fact that investors will try and seize India’s substantial assets abroad, including those of SoEs, if they get an adverse award of damages against it, and these, as seen from the existing set of above disputes, are huge.

Another cause of concern is that investors can still engage in treaty shopping, whereby they could route investments through jurisdictions having favourable treaties (with sunset clauses as applicable) using subsidiaries and shell companies, and consequently bring ISD claims. Therefore, despite terminating the BIT, the threat of ISDs has not been completely eliminated in the immediate future. Lastly, while India is becoming more proactive with its outbound investments, as evidenced by the recent regulations on overseas investment[39], the present Model BIT may limit the protection Indian investors may want to avail for themselves while investing abroad.

It would be interesting to see how India approaches this issue in the future. A model proposed by the EU is to replace the ad hoc bilateral court altogether and replace it with a permanent multilateral court. However, this requires broad consensus. Options are also being discussed under UNCITRAL’s Working Group III for provisions of appellate mechanisms, but India remains muted in its response. There are also talks about India creating specialist courts to hear potential investor claims.

Nevertheless, India has signed a new BIT with Belarus and Kyrgyzstan which provides recourse for investment arbitration. On the other hand, its BIT with Brazil removes the mechanism of investor-state arbitration in totality for state-state arbitration.

Conclusion

In conclusion, India’s journey in the international investment treaty regime has been marked by both success and challenges. As a major destination for foreign investment, India has actively engaged in signing bilateral investment treaties (BITs) to promote foreign investment and provide investor protection. However, the experience with investor-state dispute settlement (ISDS) mechanisms has been mixed, with India facing several adverse awards and financial compensation in certain high-profile cases.

This paper has highlighted significant cases in which India received unfavourable ISDS awards, shedding light on the dangers that host states may encounter in the ISDS system. The cases analyzed, including disputes with Cairn Energy, Vodafone, and Devas Multimedia, have exposed vulnerabilities in India’s treaty negotiations, treaty drafting, and dispute resolution strategies. Issues related to taxation, vague substantive clauses, and the need for a better legal framework and capacity have been identified as key areas for improvement.

To address these challenges, India has taken proactive steps, terminating many of its investment treaties and renegotiating others based on its Model BIT. The revised model emphasizes a balance between India’s right to regulate and investment protection, with changes to the Fair and Equitable Treatment (FET) standard and procedural fairness. However, these policy changes may have implications for India’s investment landscape, with some reduction in inward investments noted after the treaty termination strategy.

While India’s efforts are aimed at improving its position in investment arbitrations, challenges remain, including the immediate threat of investors seizing Indian assets abroad and potential treaty shopping by foreign investors. The future direction of India’s approach to ISDS may involve exploring multilateral solutions, such as a permanent multilateral court or provisions for appellate mechanisms, although a broader consensus is needed. Additionally, India has signed new BITs with various countries, adopting different approaches to investor-state arbitration.

Overall, India’s engagement with investment treaty arbitration continues to evolve, driven by the desire to protect its interests as a host state, while maintaining an attractive investment environment. The road ahead will require a delicate balance between safeguarding sovereignty, ensuring a fair and transparent regulatory framework, and effectively addressing investor grievances to foster a stable and conducive investment climate. However, the benefits of BITs for emerging economies can only be observed in parallel with those of China. China has signed the highest number of BITs in the world, numbering approximately 125, but it has only been sued nine times.

Endnotes

[1] Simon Weber, What Happened To Investment Arbitration In India?, March 27, 2021, Kluwer Arbitration Blog at https://arbitrationblog.kluwerarbitration.com/2021/03/27/what-happened-to-investment-arbitration-in-india/.

[2] India-UK BIT in 1994.

[3] What Happened To Investment Arbitration In India?.

[4] Data from the Investment Dispute Settlement Navigator, Investment Policy Hub maintained by the United Nations Conference on Trade and Development (UNCTAD), available at: https://investmentpolicy.unctad.org/investment-dispute-settlement.

[5] Damages and compensation have been used interchangeably in the paper.

[6] Restitution requires the re-establishment of the situation that had existed before the commission of an internationally wrongful act or the status quo ante. See https://opil.ouplaw.com/display/10.1093/law:epil/9780199231690/law-9780199231690-e1094?prd=OPIL&q=Restitution.

[7] Masood, S. (2019, May 12,). Pakistan to accept $6 billion bailout from I.M.F. The New York Times, available at: https://www.nytimes.com/2019/05/12/world/asia/pakistan-imf-bailout.html.

[8] Gus Van Harten, “TWAIL and the Dabhol Arbitration”, 3 Trade L. & Dev. 131 (2011).

[9] See https://investmentpolicy.unctad.org/investment-dispute-settlement/cases/104/bechtel-v-india and https://www.iisd.org/itn/wp-content/uploads/2010/10/investment_investsd_may5_2005.pdf.

[10] See https://investmentpolicy.unctad.org/investment-dispute-settlement/cases/104/bechtel-v-india.

[11] White Industries Australia Limited v The Republic of India, Final Award dated 30 November 2011, UNCITRAL Arbitration.

[12] Article 4(5) of the India-Kuwait BIT provides that ‘each contracting party shall…provide effective means of asserting claims and enforcing rights with respect to investments…’. Article 4(2) of the India-Australia BIT provides the MFN provision according to which, ‘a contracting party shall at all times treat investments in its territory on a basis no less favourable than that accorded to investments or investors of any third country’.

[13] White Industries para 11.2.3 and 11.2.4.

[14] See Sebastian Perry, Logjam in Indian courts triggers BIT breach, 13 February 2012, available at: https://globalarbitrationreview.com/article/logjam-in-indian-courts-triggers-bit-breach.

[15] PCA Tribunal finds India in breach of treaty in Vodafone tax dispute, available at: https://hsfnotes.com/publicinternationallaw/2020/10/05/pca-tribunal-finds-india-in-breach-of-treaty-in-vodafone-tax-dispute/.

[17] Cairn Energy PLC and Cairn UK Holdings Limited v. The Republic of India (PCA Case No. 2016-7).

[18] Cosmo Sanderson, India liable in Vodafone tax dispute, 25 September 2020, available at: https://globalarbitrationreview.com/article/india-liable-in-vodafone-tax-dispute.

[21] CC/Devas (Mauritius) Ltd., Devas Employees Mauritius Private Limited, and Telcom Devas Mauritius Limited v. Republic of India, PCA Case No 2013-09, Award on Jurisdiction and Merits, July 25, 2016 (CC/Devas v. India) and Deutsche Telekom AG v Republic of India, PCA Case No. 2014-10, Interim Award, December 13, 2017 (DT v. India).

[22] CC/Devas v. India.

[23] The fair and equitable treatment obligation places an obligation on the host State to treat foreign investors non-arbitrarily, with due process, and protect the legitimate expectations of the foreign investors.

[24] CC/Devas v. India, , para 468. Also see DT v India, para 388.

[25] CC/Devas (Mauritius) Ltd., Devas Employees Mauritius Private Limited, and Telcom Devas Mauritius Limited v. Republic of India, PCA Case No 2013-09, Award on Quantum, October 13, 2020 (CC/Devas, Award on Quantum).

[26] DT v. India, para 286.

[27] DT v. India, para 390.

[28] Deutsche Telekom AG v Republic of India, Petition to Recognize and Confirm Foreign Arbitral Award, United States District Court, District of Columbia, April 19, 2021, para 5.

[29] William W Park, ‘Arbitrability and Tax’ in Loukas A Mistelis and Stavros L Brekoulakis (eds.), Arbitrability: International & Comparative Perspectives (Kluwer Law International 2009) p. 183.

[30] Tanjina Sharmin, Application of Most-Favoured-Nation Clauses by Investor-State Arbitral Tribunals: Implications for the Developing Countries (Springer 2020) 269.

[31] CBI files chargesheet in Antrix-Devas deal, names ex-ISRO chief Madhavan Nair, The Deccan Herald, August 11, 2016, (CBI, Chargesheet).

[32] Report of the Comptroller and Auditor General of India on hybrid satellite digital multimedia broadcasting service agreement with Devas, New Delhi: 2012-2013.

[33] Judgement of Swiss Federal Court, December 11, 2018.

[34] Metal-Tech Ltd. v. Republic of Uzbekistan, ICSID Case No. ARB/10/3, Award, October 4, 2013.

[35] Sorelec v. Libya, Paris Court of Appeal Decision on Application to Set Aside Final Award, November 17, 2020.

[36] Devas Multimedia Private Limited v. Antrix Corporation Limited, January 17, 2022, Supreme Court of India, (Devas v. Antrix).

[37] See https://globalarbitrationreview.com/devas-investors-launch-new-claim-against-india.

[38] Hartmann, Simon, and Rok Spruk. “The impact of unilateral BIT terminations on FDI: Quasi-experimental evidence from India.” The Review of International Organizations (2022): 1-38. Available at: https://link.springer.com/article/10.1007/s11558-022-09471-3.

[39] The Foreign Exchange Management (Overseas Investment) Rules, 2022 (“OI Rules”), Foreign Exchange Management (Overseas Investment) Regulations, 2022 (“OI Regulations”), and the Foreign Exchange Management (Overseas Investment) Directions, 2022 (“OI Directions”).

Tathagata Choudhury is a lawyer specializing in International Economic Law with twin Masters from IHEID, Geneva and University of London.