The false hopes and empty promises of investment treaty modernization

The Monitor | 5 October 2021

The false hopes and empty promises of investment treaty modernization

by Stuart Trew

On September 9, an investor–state dispute settlement (ISDS) tribunal released its final decision on the merits of a closely watched case pitting Eco Oro Minerals, a Canadian mining company, against the Republic of Colombia. Though both sides initially declared victory, the truth is the tribunal handed a devastating win to Eco Oro with implications for environmental protection, human rights and climate change policy in both Canada and Colombia.

This bad decision reinforces the ever-present danger of “fair and equitable treatment” guarantees, however carefully worded, in Canadian investment treaties. Importantly, Eco Oro’s win also exposes, yet again, the hollowness of our government’s insistence that investment treaties do not compromise environmental protection. Before examining both these points, let’s summarize the mining dispute at the heart of the case.

Colombia’s legal and democratic responsibility for the páramo

Since the mid 1990s, Vancouver-based Eco Oro (formerly Greystar Resources Ltd.) had hoped to extract gold from land overlapping one of Colombia’s sensitive páramo wetland regions in Santurbán, about 300 km north of Bogotá. The páramo are a unique and fragile mountain ecosystem that sustains a vast amount of the country’s biodiversity and provides freshwater to millions of people. Over 10 years, the company consolidated several concessions into a permit to explore for precious minerals. Eco Oro’s plan was to eventually build an open-pit gold mine.

Despite supportive statements from Colombian mining officials, the company was eventually denied an environmental permit for the mine in 2011, following mass anti-mining protests in the city of Bucaramanga. Meanwhile, pressure was growing in the country to ban all mining in the páramo. Through transitions in government, a policy tug of war between mining and environmental officials, and the slow pace of scientific efforts to strictly delimit the páramo boundaries, mining companies like Eco Oro waited for their moment to secure environmental permits so they could start to dig.

“

That moment never came for Eco Oro. In early 2016, a Colombian Constitutional Court affirmed that the protection of water and the environment takes legal precedence over economic interests in the páramo, which nullified Eco Oro’s fallback plan—also never fully approved by the government—to build an underground mine instead of an open-pit mine on the same site. Colombian groups organized as the Committee in Defence of the Water and Páramo of Santurbán, who have struggled for more than a decade to protect these wetlands from aggressive mining companies and pro-mining governments, celebrated this democratic win for community-backed environmental stewardship (see MiningWatch Canada for more on resistance to the Eco Oro project).

In response, Eco Oro immediately filed a notice of intent to pursue investor–state arbitration against Colombia under the investment chapter in the Canada–Colombia Free Trade Agreement (CCFTA). In December 2016, the company followed through with a notice of arbitration, which sent the case to the International Centre for Settlement of Investment Disputes (ICSID). As protocol dictates, a three-person ICSID tribunal was formed of one government-selected arbitrator (Philippe Sands), one company-selected arbitrator (Horacio A. Grigera Naón), and a tribunal president (Juliet Blanche) agreed to by both parties (the Republic of Colombia and Eco Oro).

Legitimate mining ban still breaches the free trade deal

In its claim, which is still open as the tribunal considers the matter of compensation for the firm, Eco Oro alleges that Colombia indirectly expropriated its assets and violated its minimum standard of treatment (MST) rights under articles 811 and 805, respectively, of the CCFTA. The company initially demanded US$696 million plus pre- and post-award interest (non-taxable), indemnification for any costs arising from remediating the lands it had hoped to exploit for gold, and a requirement for Colombia to cover all legal costs and expert fees incurred by the company in fighting the case.

After a lengthy investigation involving dozens of witnesses—and the rejection of an amicus curiae submission from Colombian water defenders—the tribunal issued a divided decision on September 9. On the one hand, one majority (Sands with Blanche) found that no expropriation of investment had taken place, even though Eco Oro lost its alleged (and disputed—see below) right to exploit the concession, since the mining ban was unambiguously designed to protect the páramo and did not discriminate between local and foreign firms.

However, a different majority (Grigera Naón with Blanche) agreed with the company that its rights to “fair and equitable treatment” had been violated in a way that breached the CCFTA’s minimum standard of treatment protections. In other words, legitimate exercise of authority or not, Colombia must pay for its popular, constitutionally valid mining ban. As summarized by Investment Arbitration Reporter:

The tribunal majority concluded that, in refusing to allow mining exploitation activities to take place in the entire concession area without payment of compensation, adopting an inconsistent approach to the paramo’s delimitation, and ultimately failing to delimit the páramo, Colombia had frustrated Eco Oro’s legitimate expectations, and it had also failed to provide a stable and predictable regulatory environment.

It should be noted that Eco Oro never sought compensation through the Colombian courts and relinquished that right when it began ICSID proceedings against the state. As the tribunal points out in its reasoning on the allegation of expropriation, the Canadian firm also should have known that its ability to exploit the concession could have been compromised by changes to the mining regulations based on growing concern about protecting the páramo. It should have done more due diligence, even though and especially because the government’s position was shifting in response to public opposition to any mining in the region.

This deference to policy space and acknowledgment of the complexities of environmental governance, at least on the point of whether the ban expropriated Eco Oro’s investment, vanishes on the point of whether there was a breach of Article 805 (MST) of the CCFTA. So does any deference to the intentions of the Canadian and Colombian governments in how this article should be interpreted or in fact how it is written in the agreement.

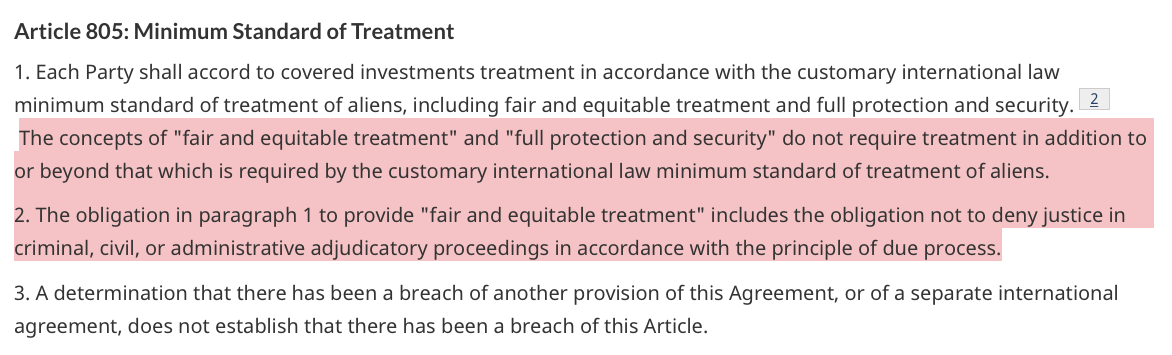

To make its case against Colombia, the tribunal imports much broader “fair and equitable treatment” language from EU-style treaties and other ICSID case law—language Canada and Colombia tried carefully to omit from their treaty (see the highlighted text below).

“The ordinary meaning of ‘fair’ and ‘equitable’ is ‘just’, ‘even-handed’, ‘unbiased’ and ‘legitimate.’ Thus, actions that infringe a sense of fairness, equity and reasonableness will fall afoul of Article 805,” asserts the tribunal. Having read into the CCFTA fair treatment language that isn’t there, the tribunal majority goes a step further to find a hard right (for foreign investors) to a “predictable business environment” within the treaty’s preamble.

In a dissenting opinion attached to the Eco Oro decision, Sands disputes this “novel” approach to determining whether the CCFTA’s “minimum standard of treatment” guarantees had been breached (emphasis mine):

"As acknowledged by both the [International Court of Justice] and the [International Law Commission], the fact that the FET provision can be found in a number of treaties is not enough to affect the content of customary international law. Indeed, the widespread inclusion of FET provisions supports the opposite conclusion, as states which include such provisions in their treaties may be understood as expressing a desire to depart from the standard in customary international law."

Sands adds: “there is a cardinal distinction between the two standards (FET and MST), and in carrying out its task the duty of a tribunal is bound to take that distinction and apply it to the facts of the case. A failure to do so amounts to a departure from the intentions of the drafters of the FTA.”

To emphasize the point, Article 805 of the CCFTA attempts to delimit the meaning of “fair and equitable treatment” as treatment “which is required by the customary international law minimum standard of treatment of aliens,” including “the obligation not to deny justice in criminal, civil, or administrative adjudicatory proceedings in accordance with the principle of due process.” The “standard of treatment” provisions in EU investment treaties, in comparison, can be breached for vague and ill-defined reasons such as “a fundamental breach of due process,” “manifestly arbitrary conduct,” or “abuse of power or similar bad faith conduct.”

In reading into the “minimum standard of treatment” in the CCFTA these broader definitions of “fair and equitable treatment” from EU-style treaties, the tribunal “might be said to manifestly exceed its powers,” claims Sands in his dissenting opinion. What’s more, the obligation to provide the company with a stable and predictable investment environment “has no foundation in the FTA or in the case law on the MST,” he writes.

More fundamentally, Sands says that, without any evidence of a “quasi-contractual” guarantee to either exploit its mining claim in the paramós or be compensated otherwise, Eco Oro had no legitimate expectations that could justify a MST violation in this respect. On this point, the Colombia-appointed arbitrator was outvoted by a tribunal majority, which decided the company had proven it had both the right to explore and to extract from its concession.

Who cares what the treaty says?

With respect to the charge of arbitrariness, Sands makes an important point about the policy confusion, less-than-ideal decisions and conflict that will inevitably plague governmental actions to protect the environment. “To be clear, the Respondent has not acted perfectly in its management of the páramo,” he says, “but the MST standard does not require it to have done so. Neither the MST nor the FTA offer a right against confusion.”

Incredibly, the tribunal majority of Grigera Naón and Blanche found to the contrary. Having earlier declared a reluctance to second-guess public policy, the tribunal asserts that Colombia should have taken stronger action to protect the paramo. For example, they propose the Colombian government should not have granted Eco Oro its mining interest in the first place, or any of the dozens of other dozens of permits near the páramo.

The tribunal notes that, while environmental officials in government were attempting to enforce protection zones around the páramo, mining officials were saying things like, “We need to make sure these projects happen, because we need royalties for development.” The totality of these actions “comprise conduct that failed to provide Eco Oro with a stable and predictable regulatory environment,” and rise to the level of “manifest arbitrariness” contrary to the alleged FET guarantees in CCFTA, it writes.

Coming back to the intentions of Canada and Colombia in the drafting of the investment rules, Sands comments that the tribunal majority’s approach, in general, “fails to respect the text agreed by the drafters of the FTA, and is likely to undermine the protection of the environment.”

Perhaps foreseeing a finding against Colombia, the Canadian government made the remarkable step of drafting a non-disputing party submission, accepted by the ICSID tribunal in February 2020 and endorsed by the Colombian government. In a section titled “Proper Interpretation and Application of Article 2201,” Canada describes how tribunals should apply several exceptions in that article of the CCFTA for legitimate environmental measures (emphasis mine):

"For the general exception in Article 2201(3) to apply, the measure must (1) not be applied in a manner that constitutes arbitrary or unjustifiable discrimination between investments or between investors, or a disguised restriction on international trade or investment; (2) relate to one of the policy objectives set out in paragraphs (a)-(c) (which includes the protection of the environment) and (3) be “necessary” to achieve these objectives. If the general exception applies, then there is no violation of the Agreement and no State liability. Payment of compensation would therefore not be required."

According to this interpretation, if a tribunal has already found that the mining ban was legitimate and non-discriminatory, related to the protection of the environment (objective [a] in Article 2201), and was “necessary” to achieving that objective—as the mining ban is under the Colombian constitution and Colombia’s international obligations to protect biodiversity—then no violation of the CCFTA investment chapter has occurred and there should be no compensation.

But in what one legal expert called an “eye-popping” conclusion, the tribunal decided “it is simply not credible” that Canada and Colombia, when they drafted the MST provisions in the treaty, didn’t make this distinction clearer up front. Basically, Canada was wrong to interpret the environmental exception in this way in its non-disputing party submission, and we’re going to compensate Eco Oro anyway. Here’s the exact wording of the tribunal:

"Given that the FTA is equally supportive of investment protection, had it been the intention of the Contracting Parties that a measure could be taken pursuant to Article 2201(3) without any liability for compensation, the Article would have been drafted in similar terms as Annex 811(2)(b), namely making explicit that the taking of such a measure would not give rise to any right to seek compensation under Chapter Eight."

Wolfgang Alschner of the University of Toronto, in a surprised Tweet following the release of the Eco Oro decision, notes the tribunal ignored an “explicit hierarchy” in the CCFTA exception (i.e., environmental protection is greater than investment protection) and “reproduced the reasoning of past awards rendered under agreements without exceptions that states must protect the environment while observing investment commitments.”

In other words, the modernizing language of Canadian trade and investment treaties doesn’t work. Tribunals will do what they want, in this case to the benefit of international mining firms and with significant harm to democracy and the protection of the environment in Colombia.

Colombia’s taxpayers are now on the hook to compensate Eco Oro, at a level to be set by the tribunal in the next phase of the arbitration. Though it will likely be less than the nearly US$700 million sought, ordering any amount of compensation is problematic as it codifies the unacceptable view that governments must pay off foreign investors when they protect the environment.

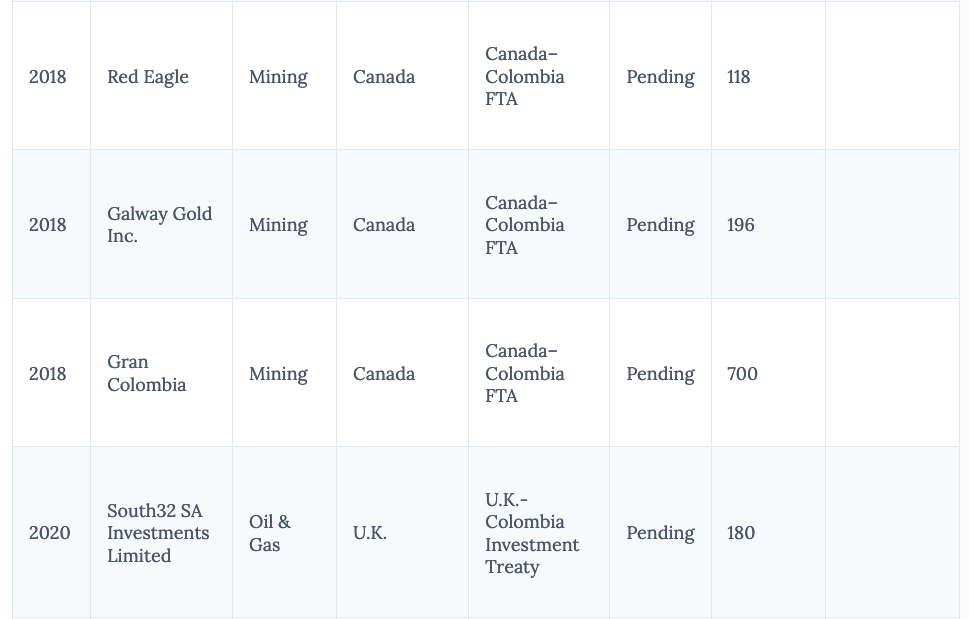

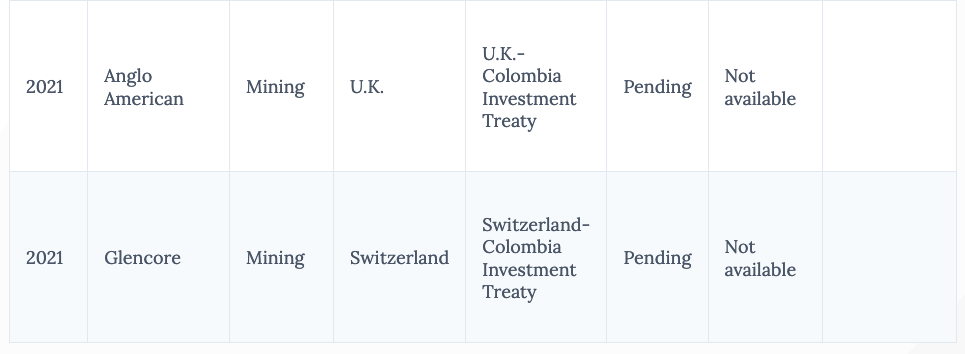

The Colombian government has been slammed by ISDS cases over the past 10 years, as this chart prepared by Manuel Perez-Rocha of the Institute for Policy Studies shows. The country can hardly afford the rising legal costs and awards it will be expected to pay, simply for doing its duty under the constitution.

ISDS Claims Against Colombia by Country and Treaty

Source: Chart compiled by Manuel Perez-Rocha, Institute for Policy Studies

The Eco Oro decision does not set a binding precedent in the parallel cases related to the paramo mining ban (Galway Gold vs. Colombia and Red Eagle vs. Colombia). But it is a clear setback for the security of environmental protection measures under the CCFTA and could embolden arbitrators to rule against Colombia in future cases.

Implications for Canada

Our governments—in Colombia and Canada—claim that modern language in investment treaties and FTAs can protect more policy space by limiting the scope of “minimum standard of treatment” and “fair and equitable treatment” provisions. Again and again, private tribunals show that this is not the case. Arbitrators, like those in the Eco Oro case, will rule expansively in the interest of private capital over government’s right to regulate.

This case should trigger soul-searching at Global Affairs Canada about the adequacy of its investment treaty reform agenda. Canada’s 2021 model Foreign Investment Protection Agreement strips the minimum standard of treatment clause of references to “fair and equitable treatment” and is limited to six serious breaches of judicial and administrative due process. But there is no guarantee our investment treaty partners will agree to this language in future negotiations—and no proof that these limits would work in practice. UNCITRAL Working Group III negotiations on multilateral reforms to the ISDS regime are procedural only and insufficient to the task of securing policy space for governments to address today’s fundamental challenges.

More urgently, given the two outstanding ISDS cases against the same Colombian mining ban at issue in the Eco Oro case, the Canadian and Colombian governments could draft a definitive exclusion from CCFTA investor–state arbitration of any and all good-faith measures to protect the environment, Indigenous peoples, human rights, workers and other affected communities, or to reduce carbon emissions. This would at least provide some clarity to future investor–state arbitration panels of the countries’ objectives.

Unfortunately, Canada and Colombia may have, at best, only a half-hearted interest in radically reining in their investment treaties, precisely because these rules enhance the investment environment from the perspective of mining companies. Canada is a major exporter of mining investment and seeks to attract firms to establish in Canada to take advantage of these treaties. Some Colombian government officials and elected politicians may feel these treaties improve the country’s ranking as a destination of international mining investment, or perhaps that they will put a “regulatory chill” on efforts to protect land and water from extractive activities.

At the same time, popular resistance to extractivism, growing Indigenous sovereignty movements, and the overwhelming weight of the global environmental crisis strengthen the hand of ISDS abolitionists over reformers. Canada is in a good position to seek to remove ISDS from its investment treaties and free trade deals, including with Colombia, in line with the removal of ISDS (between Canada and the U.S.) from the renegotiated NAFTA (CUSMA). It is the surest and most progressive way to protect government’s right to regulate today’s biggest, messiest policy challenges.

Stuart Trew is a senior researcher at the Canadian Centre for Policy Alternatives and the director of the centre’s Trade and Investment Research Project. He thanks Jen Moore, Scott Sinclair, Jamie Kneen and Manuel Perez-Rocha for their helpful feedback on this blog. Any errors are the author’s alone.