29-Oct-2020

Globe Newswire

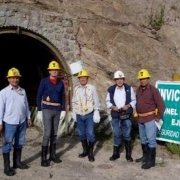

The dispute stems from the Community of Parán’s actions, which invaded Lupaka’s project held through Invicta Mining Corp.

29-Oct-2020

Climate Home News

Brussels’ proposed green reforms to the Energy Charter Treaty face resistance from Japan, yet do not go far enough for environmental campaigners.

27-Oct-2020

Michigan Journal of International Law

The problem with the ISDS is not the format of the dispute settlement. The problem is that it is designed to give corporations power to go after government policies.

27-Oct-2020

Business Today

Solicitor General Tushar Mehta has advised the government that the decision of an arbitration tribunal cannot contradict the law passed by a sovereign parliament.

26-Oct-2020

Bar and Bench

The scope of consent to arbitration is an important issue that needs to be finally settled - not least because it could have multi-billion dollar implications for India in respect of other cases involving challenges to India’s taxation measures by foreign investors.

20-Oct-2020

Friends of the Earth International

Our call to suspend all ISDS cases during and beyond the COVID-19 crisis.

9-Oct-2020

Journal of Economic Surveys

74 studies find robust evidence that effect of international investment agreements on foreign direct investment is so small as to be considered zero.

5-Oct-2020

Clean Energy Wire

The German government writes that around 21.7 million euros have been spent on lawyers, expert witnesses and court fees.